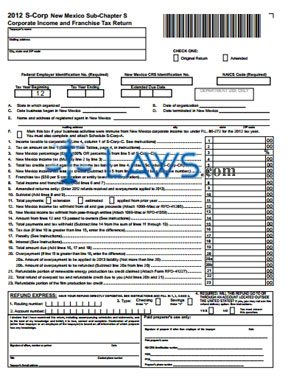

Form S-Corp S Corporate Income and Franchise Tax Return

INSTRUCTIONS: NEW MEXICO SUB-CHAPTER S CORPORATE INCOME AND FRANCHISE TAX RETURN (Form S-CORP)

S corporations doing business in New Mexico file their income and tax return with a form S-Corp. This document is obtained from the website of the Taxation and Revenue Department of the state of New Mexico.

New Mexico Sub-Chapter S Corporate Income And Franchise Tax Return S-Corp Step 1: At the top left hand corner, enter the name and mailing address of the taxpayer. Indicate with a check mark whether you are filing an original or amended return.

New Mexico Sub-Chapter S Corporate Income And Franchise Tax Return S-Corp Step 2: Enter your federal identification number and NAICS code. Enter your state CRS ID number if one has been issued. Enter the beginning and ending dates of the tax year you are filing for. If you have received an extended due date, enter it where indicated.

New Mexico Sub-Chapter S Corporate Income And Franchise Tax Return S-Corp Step 3: On lines A and B, give the state in which your corporation was organized and the date. On line C, give the date on which you began doing business in New Mexico. If applicable, enter the date on which you ceased operating in the state on line D. Give the name and address of your New Mexico registered agent on line E.

New Mexico Sub-Chapter S Corporate Income And Franchise Tax Return S-Corp Step 4: S Corporations which have federal taxable income should skip to schedule S-Corp-C on the third page before completing the first page. To complete this part of the return, you will need your federal return 1120S, Schedule D. Transfer the New Mexico taxable percentage of your income from line 5 here to line 3 on the first page.

New Mexico Sub-Chapter S Corporate Income And Franchise Tax Return S-Corp Step 5: Complete lines 1 through 23 as instructed in order to determine your tax owed to New Mexico.

New Mexico Sub-Chapter S Corporate Income And Franchise Tax Return S-Corp Step 6: Schedule S-Corp-1 computes income taxable to owners.

New Mexico Sub-Chapter S Corporate Income And Franchise Tax Return S-Corp Step 7: Schedule S-Corp-A is for S corporations which operate in multiple states to determine their New Mexico apportionment factor. Schedule S-Corp-B calculates allocated non-business income taxable to owners.