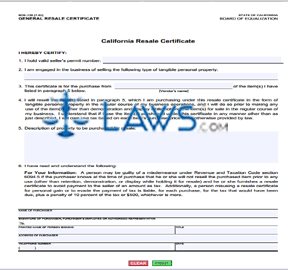

Form BOE 230 California Resale Certificate

INSTRUCTIONS: CALIFORNIA RESALE CERTIFICATE (Form BOE-230)

California businesses which purchase tangible personal property for the purpose of resale are exempt from sales tax on the items in question. The business must file a form BOE-230 with the seller to certify that it intends to use these products for resale. Otherwise, the seller is required to assess sales tax. This document can be found on the website of the California Board Of Equalization.

California Resale Certificate BOE-230 Step 1: In the first section, give your seller's permit number.

California Resale Certificate BOE-230 Step 2: In the second section, give a description of the type of tangible personal property sold by your business.

California Resale Certificate BOE-230 Step 3: In the third section, give the name of the vendor from whom you are making this purchase.

California Resale Certificate BOE-230 Step 4: Read the fourth section. This paragraph states that the purchases described below are made for the purpose of resale and that sales tax must be paid if they are put to other use.

California Resale Certificate BOE-230 Step 5: In the fifth section, write a description of the property involved in this transaction.

California Resale Certificate BOE-230 Step 6: Under the sixth section, enter the name of the purchaser.

California Resale Certificate BOE-230 Step 7: On the next line, the purchaser, their employee or an authorized representative should give their signature.

California Resale Certificate BOE-230 Step 8: On the next line, this should print their name and provide their title.

California Resale Certificate BOE-230 Step 9: On the next line, the purchaser should enter their address.

California Resale Certificate BOE-230 Step 10: On the last line, the purchaser should give their telephone number and enter the date.

California Resale Certificate BOE-230 Step 11: This document should be filed with the seller. Once the seller receives this certificate, they should confirm that the permit number given is valid. Instructions on how to do so are provided in a separate instructional pamphlet concerning this exemption available on the website of the State Board of Equalization.

California Resale Certificate BOE-230 Step 12: This certificate must be received before the purchaser is billed, within your normal billing and payment cycle or at any time before the item is delivered. The seller must maintain this certificate in their financial records.