Form 82162 Affidavit of Property Value

INSTRUCTIONS: ARIZONA AFFIDAVIT OF PROPERTY VALUE (Form 82162)

Arizona buyers and sellers of real property or their agents are required to complete an affidavit of property value. This form 82162 can be found on the website of the Arizona Department of Revenue.

Arizona Affidavit Of Property Value 82162 Step 1: Section 1 requires you to provide the assessor's parcel identification numbers.

Arizona Affidavit Of Property Value 82162 Step 2: Section 2 requires you to provide the seller's name and address.

Arizona Affidavit Of Property Value 82162 Step 3: Section 3a requires you to provide the buyer's name and address.

Arizona Affidavit Of Property Value 82162 Step 4: Section 3b requires you to indicate if the buyer and seller are related. If so, state the relationship.

Arizona Affidavit Of Property Value 82162 Step 5: Section 4 requires you to provide the address of the property.

Arizona Affidavit Of Property Value 82162 Step 6: Section 5 requires you to provide the address to which the tax bill should be sent.

Arizona Affidavit Of Property Value 82162 Step 7: Section 6 requires you to indicate the property type with a check mark.

Arizona Affidavit Of Property Value 82162 Step 8: If you checked b, c, d or h in section 6, you must indicate the residential buyer's use with a check mark in section 7. Otherwise, leave this section blank.

Arizona Affidavit Of Property Value 82162 Step 9: If you checked e or f in section 6, complete section 8. Otherwise, leave this section blank.

Arizona Affidavit Of Property Value 82162 Step 10: Indicate the type of deed or instrument with a check mark in section 9.

Arizona Affidavit Of Property Value 82162 Step 11: In section 10, enter the sale price.

Arizona Affidavit Of Property Value 82162 Step 12: In section 11, give the date of sale.

Arizona Affidavit Of Property Value 82162 Step 13: In section 12, enter the down payment.

Arizona Affidavit Of Property Value 82162 Step 14: Indicate the method of financing with a check mark in section 13.

Arizona Affidavit Of Property Value 82162 Step 15: Section 14 concerns personal property.

Arizona Affidavit Of Property Value 82162 Step 16: If only partial interest is being sold, document this in section 15.

Arizona Affidavit Of Property Value 82162 Step 17: Complete sections 16 through 18 as directed. Sign and date the form where indicated.

Form JD-CV-81 Uniform Procedures For Foreclosure By Sale Matters

INSTRUCTIONS: CONNECTICUT UNIFORM PROCEDURES FOR FORECLOSURE BY SALE MATTERS (Form JD-CV-81)

Form JC-CV-81 is an instructional document designed to assist committees in the performance of their duties in a Connecticut foreclosure case. This document can be obtained from the website of the Connecticut Judicial Branch.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 1: The first paragraph is a general introduction to this document.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 2: The next five paragraphs outline the general responsibilities of the committee, including how to delegate committee responsibilities, conducting title searches, working with the plaintiff's attorney and reviewing the foreclosure file.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 3: The next paragraph documents how often committee members should expect to have to appear in court.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 4: The next two paragraphs concern legal advertisements on the website of the Judicial Branch and in a newspaper, as well as obtaining the permission of the court for a display advertisement.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 5: The next paragraph concerns hiring a disinterested appraiser.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 6: The next paragraph concerns placing a sign on the premises in question, which in general must be done not less than 20 days before or more than 30 days prior to the sale.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 7: The next two paragraphs concern access to premises.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 8: The next paragraph concerns hiring a police officer to assist in foreclosure proceedings.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 9: The next paragraph concerns hiring a locksmith.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 10: The next paragraph concerns the condition of the premises.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 11: The next paragraph concerns making the premises viewable.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 12: The next two paragraphs concern auction proceedings.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 13: The next three paragraphs concern post-sale procedures.

Connecticut Uniform Procedures For Foreclosure By Sale Matters JD-CV-81 Step 14: The last two paragraphs concerns fees and costs.

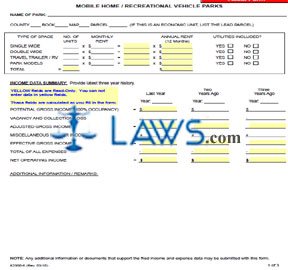

Form 82505 Mobile Home Park and Trailer Court Operator’s Report to County Assessor

Form 82530 Personal Property Petition for Review of Valuation

Form JD-CV-86 Motion For First Order of Notice – Foreclosure Action

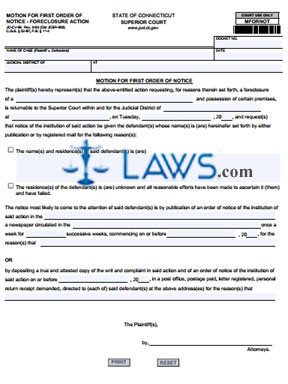

INSTRUCTIONS: CONNECTICUT MOTION FOR FIRST ORDER OF NOTICE – FORECLOSURE ACTION (Form JD-CV-86)

To request that a first order of notice be issued to the defendant in a Connecticut foreclosure action, a form JD-CV-86 should be completed. This document can be obtained from the website of the Connecticut Judicial Branch.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 1: Enter the docket number in the first blank box.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 2: Enter the case name in the second blank box.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 3: Enter the date in the third blank box.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 4: Enter the name of the judicial district in the fourth blank box.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 5: Enter the location of your court in the fifth blank box.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 6: On the first blank line, enter the type of property that is being foreclosed on.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 7: On the next blank line, enter the name of the judicial district.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 8: On the next blank line, enter the city or town of the judicial district.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 9: Enter the date on which you are filing this motion on the next blank line.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 10: Enter the last two digits of the year in which you are filing on the next blank line.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 11: Check the first box if you know the name and address of the defendants and enter it. Check the second box if you do not know their address and all reasonable efforts to ascertain it have failed.

Connecticut Motion For First Order Of Notice – Foreclosure Action JD-CV-86 Step 12: Complete the blanks in the last two paragraphs to specify whether you wish for notification to take place through a newspaper advertisement or through the mail.