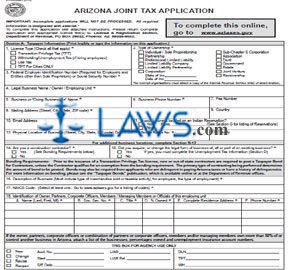

INSTRUCTIONS: ARIZONA JOINT TAX APPLICATION (Form JT-1)

To license a new business in Arizona or change ownership on an existing business, file a form JT-1. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Joint Tax Application JT-1 Step 1: In Section A, indicate with check marks the type of license you are seeking and the type of ownership of your business.

Arizona Joint Tax Application JT-1 Step 2: Enter your federal employer identification number, legal business name and trade name, phone and fax number, address, email address, and physical location. Indicate whether you are located on an Indian reservation.

Arizona Joint Tax Application JT-1 Step 3: Indicate if you are a construction contractor or if you have acquired or changed the legal form of any part of a business.

Arizona Joint Tax Application JT-1 Step 4: Enter a description of your business, its NAICS code, and provide all information requested about owners, partners, corporate officers, members, managing members, and officials.

Arizona Joint Tax Application JT-1 Step 5: In Section B, provide all information required in order to be granted a Transaction Privilege Tax license. Note that to determine your business class or classes on line 4, you will need to consult Schedule H, which is located on the bottom of the fourth page.

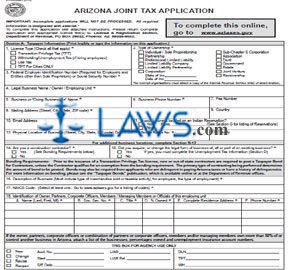

Arizona Joint Tax Application JT-1 Step 6: In Section C, you must compute all local taxes which apply to locations in which you are doing business. Total these tax fees at the bottom of the section.

Arizona Joint Tax Application JT-1 Step 7: Section D concerns information about state taxes withheld from worker wages and unemployment taxes paid. Include all information requested about previous business owners.

Arizona Joint Tax Application JT-1 Step 8: At the bottom of the page, indicate whether or not you are offering unemployment insurance coverage.

Arizona Joint Tax Application JT-1 Step 9: In Section E, you may authorize yourself or another person to work with your tax documents on the website of the Arizona Department of Revenue.

Arizona Joint Tax Application JT-1 Step 10: In Section F, one or two sole owners, partners, corporate officers, managing members, or trustees, receivers or personal representatives of an estate must type or print their names, give their title and the date, and provide a signature.

Demystifying Form JT-1: The Joint Tax Application for a Business License

Starting a business is an exciting venture, but it also comes with a host of administrative responsibilities. One crucial aspect of getting your business off the ground is obtaining the necessary licenses and permits. In many jurisdictions, the process begins with completing Form JT-1, also known as the Joint Tax Application for a Business License. In this comprehensive guide, we will demystify Form JT-1, exploring its purpose, components, and how to fill it out correctly. Whether you're a seasoned entrepreneur or a first-time business owner, understanding this form is essential to ensure your venture complies with local tax regulations and operates legally.

Understanding Form JT-1

The Basics

Form JT-1 is a standardized document used in various states and localities across the United States. Its primary purpose is to collect essential information from business owners for tax and licensing purposes. Essentially, it serves as a one-stop-shop for reporting your business's details to local tax authorities and obtaining the necessary licenses to operate legally.

Why Is It Important?

Completing Form JT-1 is crucial for several reasons:

- Legal Compliance: In most jurisdictions, operating a business without the required licenses and permits is illegal. Filling out Form JT-1 helps you start your business on the right side of the law.

- Tax Obligations: Accurate information on this form ensures that you are correctly assessed for local taxes, such as sales tax, property tax, or business income tax.

- Record Keeping: The information you provide on Form JT-1 becomes part of your official business record. This record can be valuable for future reference, audits, or interactions with government agencies.

Now that we understand the significance of Form JT-1, let's delve into its components and how to complete it accurately.

Components of Form JT-1

- Business Information

The first section of Form JT-1 focuses on collecting basic information about your business. This includes:

- Business Name: The legal name of your business entity, whether it's a sole proprietorship, partnership, corporation, or LLC.

- Business Address: The physical location of your business. In some cases, if you operate from multiple locations, you may need to provide details for each.

- Mailing Address: If your mailing address is different from your physical location, you should indicate it here.

- Business Phone Number: A contact number where authorities can reach your business.

- Ownership Information

This section requires details about the ownership structure of your business, such as:

- Ownership Type: Indicate whether your business is a sole proprietorship, partnership, corporation, or LLC.

- Owner Information: Provide personal information for all owners, including their names, social security numbers or EINs (Employer Identification Numbers), and percentage of ownership.

- Contact Information: Include contact details for all owners, such as home addresses and phone numbers.

- Business Activity

In this section, you'll describe the nature of your business activities. This information helps tax authorities determine which taxes or licenses are applicable to your business. Be specific and accurate in your description.

- Tax Information

This is a critical section where you specify which taxes your business is subject to. Common taxes include:

- Sales Tax: If your business sells taxable goods or services, you'll need to indicate your obligation to collect and remit sales tax.

- Income Tax: Specify if your business generates income that is subject to local income tax.

- Other Taxes: Depending on your location and business type, you may have other tax obligations, such as property tax or use tax.

- Licensing and Permits

Here, you'll list all the licenses and permits required for your business. These can vary widely based on your location and industry. Common examples include:

- Business License: This is often the primary license you're applying for using Form JT-1. It gives your business the legal authority to operate within the jurisdiction.

- Health Department Permits: If your business involves food service or healthcare services, you may need specific permits from the health department.

- Alcohol or Tobacco Licenses: If your business deals with alcohol or tobacco products, you may require special licenses.

- Signature and Certification

Finally, Form JT-1 typically requires the signature of the business owner or an authorized representative. This signature confirms that the information provided is accurate and complete to the best of their knowledge.

How to Fill Out Form JT-1

Completing Form JT-1 can seem daunting, especially if you're a first-time business owner. Here's a step-by-step guide to help you navigate the process:

Step 1: Obtain the Form

You can usually obtain Form JT-1 from your local government's website or by visiting the relevant department or office in person. Make sure you have the most recent version of the form, as requirements can change over time.

Step 2: Gather Information

Before you start filling out the form, gather all the necessary information. This includes your business's legal name, physical and mailing addresses, ownership details, and a clear description of your business activities.

Step 3: Complete the Form

Follow the form's instructions carefully and complete each section accurately. Double-check your entries to ensure there are no errors or omissions.

Step 4: Attach Required Documents

In some cases, you may need to attach supporting documents to your Form JT-1. These could include copies of your business's articles of incorporation, lease agreements, or other relevant paperwork. Check the form's instructions to see what's required.

Step 5: Review and Sign

Review the completed form to make sure all information is accurate. Then, sign and date the form. If someone other than the business owner is signing, ensure they have the authority to do so.

Step 6: Submit the Form

Submit the completed Form JT-1 and any required documents to the appropriate government office or department. Pay any associated fees or taxes at this time, if applicable.

Step 7: Follow Up

After submitting Form JT-1, follow up with the relevant authorities to track the progress of your application. They may require additional information or clarification before issuing your business license.

Tips for Success

Filling out Form JT-1 correctly and efficiently is essential for a smooth business startup process. Here are some additional tips to ensure success:

- Research Your Requirements: Before starting the form, research the specific licensing and tax requirements for your business type and location. This will help you provide accurate information.

- Seek Professional Assistance: If you're unsure about any part of the form or have a complex business structure, consider consulting with a tax professional or attorney who specializes in business licensing.

- Keep Records: Make copies of your completed Form JT-1 and any supporting documents for your records. This will help you in case of future audits or inquiries.

- Stay Informed: Tax laws and licensing requirements can change, so stay informed about any updates or changes that may affect your business.

Conclusion

Form JT-1, the Joint Tax Application for a Business License, is a critical document for any business owner. By understanding its components and following the steps outlined in this guide, you can navigate the process successfully and ensure that your business operates legally and in compliance with local tax regulations. Remember that compliance is an ongoing responsibility,

so stay informed and up-to-date on any changes that may impact your business in the future. With the right knowledge and preparation, you can embark on your entrepreneurial journey with confidence and peace of mind.