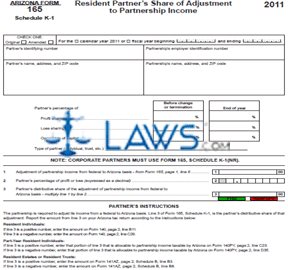

Form 165 Schedule K-1 Schedule K-1 Resident Partner’s Share of Adjustment to Partnership Income

INSTRUCTIONS: ARIZONA RESIDENT PARTNER'S SHARE OF ADJUSTMENT TO PARTNERSHIP INCOME (Form 165 Schedule K-1)

To document a resident partner's share of adjustment to partnership income in Arizona, a Schedule K-1 is filed along with form 165. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 1: If you are not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 2: Indicate with a check mark whether this is an original or amended form.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 3: Indicate with a check mark whether you are filing on a calendar year or fiscal year basis.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 4: In the first blank box, enter the partner's identifying number.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 5: In the second blank box, enter the partner's employer identification number.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 6: In the third blank box, enter the partner's name, address and zip code.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 7: In the fourth blank box, enter the partnership's name, address and zip code.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 8: Enter the partner's percentage of profit sharing before the change or termination in the first column and at the end of the year in the second column of the table provided.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 9: On the second line of the table, enter the partner's share of loss sharing before the change and termination in the first column and at the end of the year in the second column.

Arizona Resident Partner's Share Of Adjustment To Partnership Income 165 Schedule K-1 Step 10: Enter the partner's percentage of ownership of capital in before the change and termination in the first column and at the end of the year in the second column. Complete lines 1 through 3 as directed.

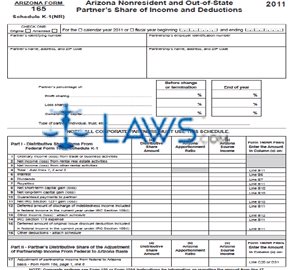

Form 165 Schedule K-1(NR) Schedule K-1(NR) Arizona Nonresident and Out-of-State Partner’s Share of Income and Deductions

INSTRUCTIONS: ARIZONA NONRESIDENT AND OUT-OF-STATE PARTNER'S SHARE OF INCOME AND DEDUCTIONS (Form 165 Schedule K-1(NR))

To document a nonresident or out-of-state partner's share of income and deductions from an Arizona partnership, a schedule K-1(NR) is filed along with form 165. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 1: Indicate whether this is an original or amended return with a check mark.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 2: Indicate whether you are filing for the calendar year listed on the form or a fiscal year basis. If the latter, give your beginning and ending dates.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 3: Enter the partner's identifying number in the first box.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 4: Enter the partner's employer identification number in the second box.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 5: Enter the partner's name, address and zip code in the third box.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 6: Enter the partnership's name, address and zip code in the fourth box.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 7: On the first line of the table below, enter the partner's percentage of profit sharing.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 8: On the second line of the table, enter the partner's percentage of loss sharing.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 9: On the third line of the table, enter the partner's percentage of ownership of capital.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 10: Enter the type of partner.

Arizona Nonresident And Out-Of-State Partner's Share Of Income And Deductions 165 Schedule K-1(NR) Step 11: Complete the tables in Part I and Part II as instructed on the second page of the document.

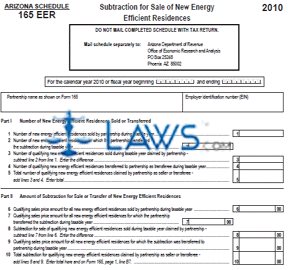

Form 165 EER EER Subtraction for Sale of New Energy Efficient Residences

Form 165 EER EER Subtraction for Sale of New Energy Efficient Residences Instructions

INSTRUCTIONS: ARIZONA SUBTRACTION FOR SALE OF NEW ENERGY EFFICIENT RESIDENCES (Form 165 EER)

To document the sale of new energy efficient residences in Arizona, a form 165 EER should be used. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 1: Enter the beginning and ending dates of your fiscal year if not filing for the calendar year printed on the form.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 2: Enter your partnership name as it appears on form 165 and your employer identification number.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 3: On line 1, enter the number of new energy efficient residences sold by the partnership during the taxable year.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 4: On line 2, enter the number of new energy efficient residences for which the partnership transferred the subtraction during the taxable year.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 5: Subtract line 2 from line 1. Enter the resulting difference on line 3.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 6: Enter the number of qualifying new energy efficient residences transferred to the partnership during the taxable year on line 4.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 7: Add lines 3 and 4. Enter the resulting sum on line 5.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 8: Enter the qualifying sales price amount for all new energy efficient residences sold by the partnership during the taxable year on line 6.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 9: Enter the qualifying sales price amount for all new energy efficient residences for which the partnership transferred the subtraction during the taxable year on line 7.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 10: Subtract line 7 from line 6. Enter the resulting difference on line 8.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 11: Complete lines 9 and 10 as directed.