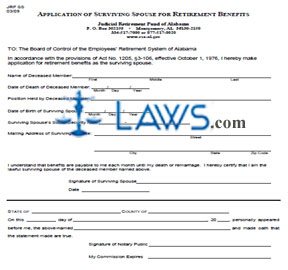

Application of Surviving Spouse for Retirement Benefits

INSTRUCTIONS: ALABAMA APPLICATION OF SURVIVING SPOUSE FOR RETIREMENT BENEFITS

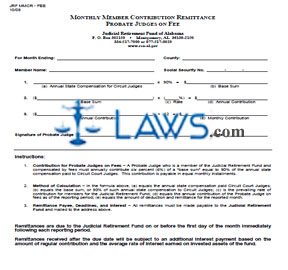

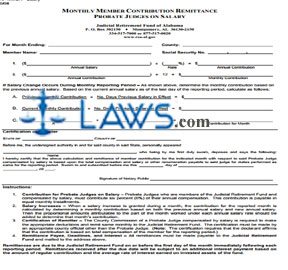

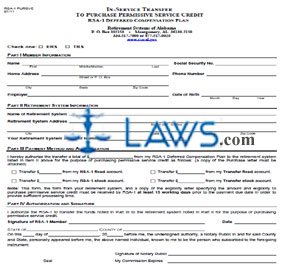

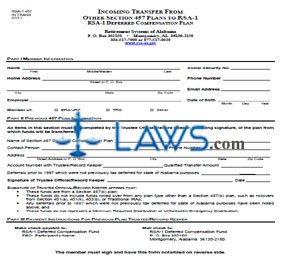

Surviving spouses of Alabama judicial employees who have died can file the document discussed in this article to request that they be granted benefits from their spouse's retirement funds. This document can be obtained from the website of the Retirement Systems of Alabama. Note that benefits for surviving spouses differ based on the position held by their late spouse. For example, the surviving spouse of a probate judge with five or greater years of creditable service is entitled to receive $480 per year multiplied by the number of years of service performed by their late spouse. This benefit cannot exceed $4,800 per year or 30% of their spouse's base sum or final judicial salary at the time of their death.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 1: On the first line, enter the first, middle and last name of the deceased spouse.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 2: On the second line, enter the date on which the deceased spouse died.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 3: On the third line, enter the position which was held by the deceased spouse.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 4: On the fourth line, enter your date of birth.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 5: On the fifth line, enter your Social Security number.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 6: On the sixth line, enter your street address.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 7: On the seventh line, enter your city, state and zip code.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 8: Sign and date the form.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 9: Appear before a notary public, who will sign and date the form as well as affixing their seal.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 10: File the document by mailing it to the Judicial Retirement Fund of Alabama at the address given at the top of the page.

Alabama Supplication Of Surviving Spouse For Retirement Benefits Step 11: Once your application is approved, you will be granted benefits until either your death or remarriage.