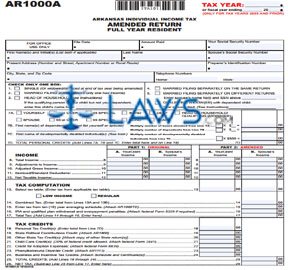

Form AR1000A Resident Individual Income Tax Amended Return

INSTRUCTIONS: ARKANSAS INDIVIDUAL INCOME TAX AMENDED RETURN FULL YEAR RESIDENT (Form AR1000A)

Arkansas full-time residents use a form AR1000A to file any amended figures regarding their original return. This document can be obtained from the website of the Arkansas Department of Finance and Administration.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 1: Give the tax year or fiscal year dates for which you are filing at the top right hand corner of the first page.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 2: Enter your name and Social Security number. If filing jointly with your spouse, provide the same information for them. Enter your present address and home and work telephone numbers.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 3: Check the filing status which applies to you on lines 1 through 6.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 4: On lines 7A through 7D, check all personal credits you are claiming.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 5: Lines 8 through 12 require you to detail your income. In the first two columns, enter your sole or joint combined income on the left and your spouse's income (if applicable) on the right as entered on your original return. Provide the same information, corrected, in the two columns on the right.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 6: Lines 13 through 17 provide instructions for computation of total tax due.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 7: Lines 18 through 27 provide instructions for computation of net tax due after all credits have been applied.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 8: Lines 28 through 35 provide instructions for computation of payments due.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 9: Lines 36 and 37 concern refunds if you have overpaid and tax due if you have underpaid.

Arkansas Individual Income Tax Amended Return Full Year Resident AR1000A Step 10: At the bottom of the page, explain all changes documented. Note with a check mark whether your tax return has been adjusted by the IRS. Attach all supporting documentation. Sign and date the form and give your occupation.