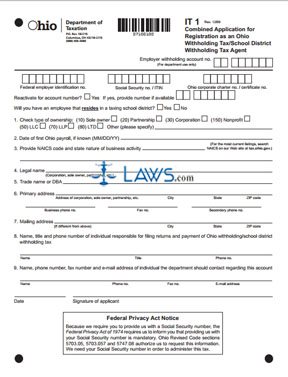

Form IT 1 Application for Registration as an Ohio Withholding Agent

INSTRUCTIONS: OHIO COMBINED APPLICATION FOR REGISTRATION AS AN OHIO WITHHOLDING TAX/SCHOOL DISTRICT WITHHOLDING TAX AGENT (Form IT 1)

To register as a school district withholding tax agent as a business owner in Ohio, a form IT 1 should be completed. This document can be obtained from the website maintained by the Ohio Department of Taxation.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 1: Enter your federal employer identification number.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 2: Enter your Social Security number or ITIN.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 3: Enter your Ohio corporate charter number or certificate number.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 4: Indicate with a check mark whether you are filing to reactivate an account number. If yes, provide the number. Indicate with a check mark whether you will have an employee residing in a taxing school district.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 5: Check the type of ownership on line 1.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 6: Give the date of your first Ohio payroll, if known, on line 2.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 7: On line 3, provide your NAICS code and state the nature of your business activity.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 8: On line 4, enter your legal name. Enter your trade name or "doing business as" name on line 5.

Ohio Combined Application For Registration As An Ohio Withholding Tax/School District Withholding Tax Agent IT 1 Step 9: Enter your primary address on line 6 and your mailing address, if different on line 7. Enter the name, title and phone number of the person who files returns and pays Ohio withholding/school district withholding tax on line 8. Enter the same information for a contact person on line 9.