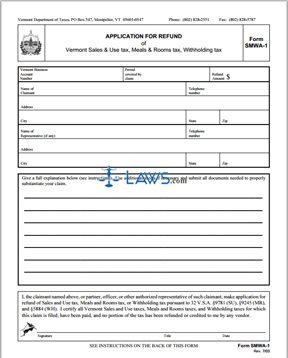

Form SMWA-1 Application for Refund

INSTRUCTIONS: VERMONT APPLICATION FOR REFUND (Form SMWA-1)

Vermont residents and businesses who believe they have overpaid sales tax, use tax, meals and room tax or their withholding tax may file a form SMWA-1 in order to request a refund. This form is found on the website of the Vermont Department of Taxes. This may be filed within three years of the payment in question. Vendors seeking a refund for uncollectible amounts have two years from the date the account was charged off their books to file.

Vermont Application For Refund SMWA-1 Step 1: The first line of the first section requires your business account number (if applicable), the period covered by your claim and the amount of the refund sought.

Vermont Application For Refund SMWA-1 Step 2: The next section requires the name of the claimant, their telephone number and full address.

Vermont Application For Refund SMWA-1 Step 3: If you are completing this form via a representative, you should include their name, address and telephone number in the next section.

Vermont Application For Refund SMWA-1 Step 4: The next section is a blank space in which you must provide a written explanation for why you are seeking a refund. Applicable reasons included bankruptcy or a disputed charge in cases of uncollectible charges. You may also file this request if tax has been paid in another form, such as a motor vehicle purchase and use tax. Attach as many additional sheets as necessary to provide a detailed explanation.

Vermont Application For Refund SMWA-1 Step 5: You must attach all documentation available to substantiate your claim. If your claim concerns uncollectible amounts, attach documentation of all applicable transactions from the account in question, including the sales amount, the amount of sales tax charged, any non-taxable charges, and credits or debits applied to your account. If filing regarding a tax that has been paid, include documentation of the other tax and Vermont sales tax being paid on the same property.

Vermont Application For Refund SMWA-1 Step 6: Credit is also granted to purchases of snowmobiles, motorboats and vessels. To seek a refund for these purchases, attach a copy of the invoice or bill of sale documenting the date of the purchase, the name and address of the purchaser, and the selling cost of the vehicle.

Vermont Application For Refund SMWA-1 Step 7: Sign and date the form. Include your job title.