Form NC-40 Individual Estimated Income Tax

INSTRUCTIONS: NORTH CAROLINA INDIVIDUAL ESTIMATED INCOME TAX (Form NC-40)

To file your individual estimated income tax in North Carolina, you must use a form NC-40. This article discusses the instructions for that document, which has the same form number. This document can be obtained from the website of the North Carolina Department of Revenue.

North Carolina Individual Estimated Income Tax NC-40 Step 1: The first page contains general instructions for completing form NC-40.

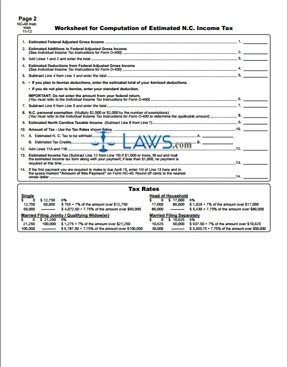

North Carolina Individual Estimated Income Tax NC-40 Step 2: The second page contains a worksheet for computation of the estimated income tax owed. On line 1, enter your estimated federal taxable income.

North Carolina Individual Estimated Income Tax NC-40 Step 3: On line 2, enter your estimated additions to federal taxable income.

North Carolina Individual Estimated Income Tax NC-40 Step 4: Add lines 1 and 2. Enter the resulting sum on line 3.

North Carolina Individual Estimated Income Tax NC-40 Step 5: On line 4, enter your estimated deductions from federal taxable income.

North Carolina Individual Estimated Income Tax NC-40 Step 6: Subtract line 4 from line 3. Enter the resulting difference on line 5. This is your estimated North Carolina taxable income.

North Carolina Individual Estimated Income Tax NC-40 Step 7: Use the tax rates shown in the table at the bottom of the page to complete line 6.

North Carolina Individual Estimated Income Tax NC-40 Step 8: On line 7A, enter the estimated North Carolina tax to be withheld.

North Carolina Individual Estimated Income Tax NC-40 Step 8: On line 7B, enter your estimated tax credits.

North Carolina Individual Estimated Income Tax NC-40 Step 9: Add lines 7A and 7B. Enter the resulting sum on line 8.

North Carolina Individual Estimated Income Tax NC-40 Step 10: Subtract line 8 from line 6. Enter the resulting difference on line 9.

North Carolina Individual Estimated Income Tax NC-40 Step 11: If required to make your first payment by April 15th, multiply line 9 by .25 and enter the resulting product on line 10. Round the figure to the nearest whole dollar.

North Carolina Individual Estimated Income Tax NC-40 Step 12: Transfer the amount from line 10 to the line labeled "Amount of this Payment" on the form NC-40 return. Keep this worksheet for your records but do not submit it with your return.