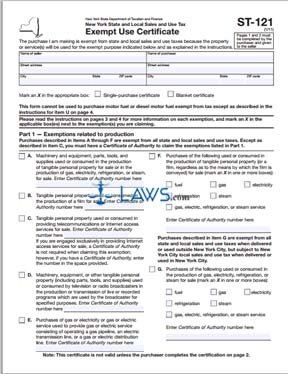

Form ST 121 Sales and Use Tax Exempt Use Certificate

INSTRUCTIONS: NEW YORK STATE AND LOCAL SALES AND USE TAX EXEMPT USE CERTIFICATE (Form ST-121)

New York organizations making purchases for tax exempt purposes should file a form ST-121 with the seller. This document provides an explanation of the type of exemption the seller is claiming and qualifies for. This form can be found on the website of the New York State Department of Taxation and Finance.

New York State And Local Sales And Use Tax Exempt Use Certificate ST-121 Step 1: At the top of the form, enter the name and address of the purchaser on the left and the name and address of the seller on the right.

New York State And Local Sales And Use Tax Exempt Use Certificate ST-121 Step 2: Indicate with an "x" whether this certificate concerns one purchase or is a blanket certificate covering multiple transactions. Note that if the latter, all sales slips and invoices must include the Certificate of Authority number.

New York State And Local Sales And Use Tax Exempt Use Certificate ST-121 Step 3: Part 1 lists exemptions related to production. If applicable, indicate with an "x" if any of these apply to you. These include purchases of machinery used in production, tangible personal property related to film production and utilities expenses.

New York State And Local Sales And Use Tax Exempt Use Certificate ST-121 Step 4: Part 2 concerns services exempt from tax. These include installation and repair costs for qualified machinery, printing costs and costs associated with waste removal from a facility regulated by the Department of Environmental Conservation.

New York State And Local Sales And Use Tax Exempt Use Certificate ST-121 Step 5: Part 3 concerns all other exemptions, such as those governing tangible personal property purchased for use in research and development, purchases of commercial fishing vessels and pollution control equipment, and purchases of qualified commercial aircraft and commercial vessels.

New York State And Local Sales And Use Tax Exempt Use Certificate ST-121 Step 6: If none of the list exemptions apply, place an "X" next to line U, "Other," and enter a written description, including the Tax Law section justifying your claim.

New York State And Local Sales And Use Tax Exempt Use Certificate ST-121 Step 7: The owner, partner or an authorized representative of the purchaser must print and sign their name, as well as entering the date this form was prepared.