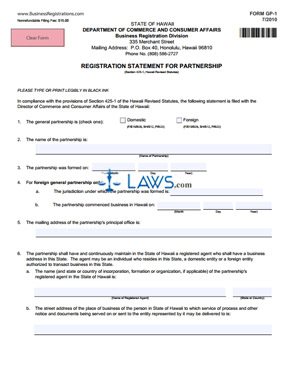

Form HI Registration Statement for Partnership

INSTRUCTIONS: HI REGISTRATION STATEMENT FOR PARTNERSHIP

This form allows a domestic partnership to form in the state. The form also allows a foreign partnership to extend authority to partners inside the state of Hawaii.

“HI Registration Statement for Partnership Step 1”

Check the appropriate box in part 1 of this form.

“HI Registration Statement for Partnership Step 2”

Provide the full name of the partnership in part 2. If you’re forming a new partnership, you’ll want to research the Department of Commerce and Consumer Affairs to make sure the name of the partnership does not already exist in the state of Hawaii. Use the following link: https://hbe.ehawaii.gov/documents/search.html;jsessionid=D177933ACD6244EBF0206404CE7953FD.luka

“HI Registration Statement for Partnership Step 3”

State when the partnership was formed in part 3. Include the month, day, and year.

“HI Registration Statement for Partnership Step 4”

If foreign general partnership is applying in Hawaii, provide the jurisdiction where the general partnership was formed in part 4a. List the date when business begun in Hawaii in part 4b.

“HI Registration Statement for Partnership Step 5”

State the mailing address for the principal office of the partnership in part 5. Include the city, state, and zip code.

“HI Registration Statement for Partnership Step 6”

List the registered agent and their street address in part 6. The registered agent can be an individual, domestic entity, or a foreign entity allowed to conduct business in the state of Hawaii. If the registered agent is an entity, provide their state or country where it was formed.

“HI Registration Statement for Partnership Step 7”

List the name and complete address for each general partner in part 7. If additional space is needed, attach a separate form.

“HI Registration Statement for Partnership Step 8”

At least one general partner needs to sign and date the bottom of this form.

“HI Registration Statement for Partnership Step 9”

A domestic partnership needs to file with the DCCA within 30 days after the partnership was formed. A foreign partnership needs to file with the DCCA within 30 days after business started in Hawaii. If the partnership fails to file with the DCCA in the required time, each partner needs to pay $25.00 every month past the required date.

“HI Registration Statement for Partnership Step 10”

Provide a filing fee of $15.00 and make the check payable to Department of Commerce and Consumer affairs.