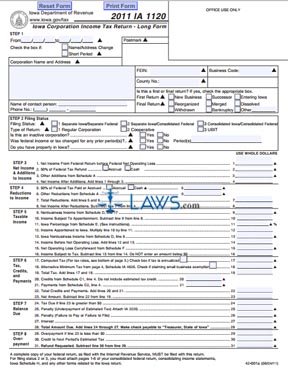

Form IA 1120 Iowa Corporation Income Tax Return Long Form

INSTRUCTIONS: IOWA CORPORATION INCOME TAX RETURN - LONG FORM (Form IA 1120)

Corporations doing business in Iowa can file their state income tax using the long form IA 1120 document. This form is found on the website of the government of Iowa.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 1: Step 1 requires that you enter the beginning and ending dates of your filing period. Give your corporation's name, address and all other requested location and identifying information.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 2: Step 2 requires you to identify your filing status.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 3: Step 3 requires you to document net income and additions to income. In order to complete line 3, you will first need to complete Schedule A on the second page.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 4: Step 4 requires you to document reductions to income. Line 6 also requires information from Schedule A.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 5: Step 5 requires you to document and calculate your taxable income. You will need to first complete Schedules E and F. Additionally, corporations operating in multiple states should also complete Schedule E to determine how much of their income is subject to taxation in Iowa.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 6: Step 6 requires you to document tax credits and payments already made. You will need to first complete schedules C1 and C2.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 7: Step 7 requires you to calculate the balance due.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 8: If you have overpaid, you will calculate your refund due in Step 8.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 9: All businesses must complete the "Additional Information" section on the second page.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 10: An officer of the firm should sign and date the bottom of the second page and provide their title.

Iowa Corporation Income Tax Return - Long Form IA 1120 Step 11: Any paid preparer should also sign and date the form and provide identifying information regarding their employer.