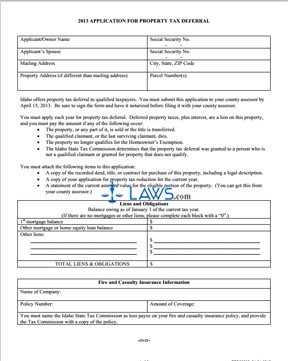

Form Application for Property Tax Deferral 2012

INSTRUCTIONS: IDAHO 2012 APPLICATION FOR PROPERTY TAX DEFERRAL

Idaho residents whose annual household income does not exceed the limit adjusted annually ($41,140 or less for tax year 2012) and who are 65 or older, blind, disabled, veterans with a 10%-or-more disability related to their service, prisoners of war, and fatherless or motherless children under the age of 18 can apply for a property tax deferral for their primary residence and up to an acre of land. This will defer taxes and interest, which must be eventually paid. This article discusses the application submitted concerning tax year 2012.

Idaho 2012 Application For Property Tax Deferral Step 1: At the top of the document, enter your name, Social Security number, mailing address, and the property address if different from your mailing address.

Idaho 2012 Application For Property Tax Deferral Step 2: If you file taxes jointly with your spouse, enter their name and Social Security number.

Idaho 2012 Application For Property Tax Deferral Step 3: In the chart labeled "Liens And Obligations," enter your first mortgage balance due on January 1 of the year in question.

Idaho 2012 Application For Property Tax Deferral Step 4: On the line below this, enter the balance of any other mortgages or home equity loans.

Idaho 2012 Application For Property Tax Deferral Step 5: Below this, list and give the balance owed on any other liens.

Idaho 2012 Application For Property Tax Deferral Step 6: Total your liens and obligations at the bottom of this table.

Idaho 2012 Application For Property Tax Deferral Step 7: In the section labeled "Fire And Casualty Insurance Information," give the name of your insurer, your policy number, and the amount of the coverage. Your fire and casualty insurance policy must name the Idaho State Tax Commission as the loss payee.

Idaho 2012 Application For Property Tax Deferral Step 8: Attach a copy of this insurance policy with your application.

Idaho 2012 Application For Property Tax Deferral Step 9: Sign and date the second page. If filing jointly with your spouse, they must also provide their signature.

Idaho 2012 Application For Property Tax Deferral Step 10: Spouses who signed the form must appear before a notary public, who will affix their seal to verify the form.

Idaho 2012 Application For Property Tax Deferral Step 11: File the document with your county assessor by April 15.