Form 82053 Pipeline Companies Reporting

INSTRUCTIONS: PIPELINE COMPANIES ARIZONA PROPERTY TAX FORM (Form 82053)

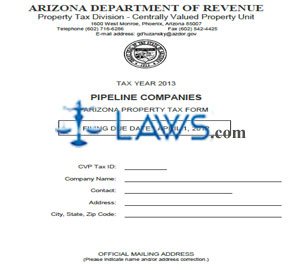

Pipeline companies operating in Arizona use a form 82053 to document their property taxes owed. This document can be obtained from the website of the Arizona Department of Revenue.

Pipeline Companies Arizona Property Tax Form 82053 Step 1: The first page is a cover page. Enter the company CVP tax ID, company name, contact person, street address, city, state and zip code.

Pipeline Companies Arizona Property Tax Form 82053 Step 2: The second page contains the table of contents.

Pipeline Companies Arizona Property Tax Form 82053 Step 3: At the top of the third page, enter the company name and CVP tax ID.

Pipeline Companies Arizona Property Tax Form 82053 Step 4: Enter the name, title and address of the person to whom all correspondence should be referred.

Pipeline Companies Arizona Property Tax Form 82053 Step 5: Enter the name and address of the Arizona manager.

Pipeline Companies Arizona Property Tax Form 82053 Step 6: Enter the type of company, indicate the type of ownership with a check mark, and indicate whether you are regulated by a regulatory agency. Enter any additional comments at the bottom of the page.

Pipeline Companies Arizona Property Tax Form 82053 Step 7: The fourth page requires you to provide information about your system financial data.

Pipeline Companies Arizona Property Tax Form 82053 Step 8: The fifth page requires you to provide information about your Arizona financial data.

Pipeline Companies Arizona Property Tax Form 82053 Step 9: The sixth page requires you to provide income data.

Pipeline Companies Arizona Property Tax Form 82053 Step 10: The seventh page requires you to provide information about non-capitalized leased or rented operating property.

Pipeline Companies Arizona Property Tax Form 82053 Step 11: The eighth page requires you to provide information about operating land additions.

Pipeline Companies Arizona Property Tax Form 82053 Step 12: The ninth page requires you to provide information about non-operating property including land and improvements.

Pipeline Companies Arizona Property Tax Form 82053 Step 13: The last page is a verification form. An authorized company official should enter the state and county on the first two blank lines, print their name, title and company on the next three blank lines and sign the form in the presence of a notary public.