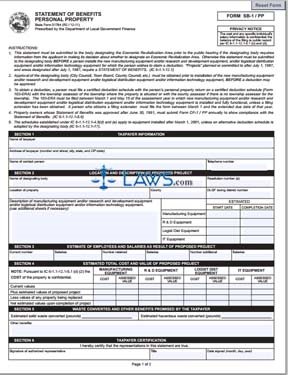

Form 51764 Statement of Benefits Personal Property

INSTRUCTIONS: INDIANA STATEMENT OF BENEFITS PERSONAL PROPERTY (Form 51764)

Indiana businesses which have projects in areas designated an Economic Revitalization Area may submit a form 51764 to obtain a property tax exemption on costs associated with these projects. The statement must be submitted prior to the installation of new equipment and approved if a deduction is to be obtained. The form is available on the website of the state of Indiana.

Indiana Statement Of Benefits Personal Property 51764 Step 1: In section one, give the name and address of the taxpayer, and the name and telephone number for a contact person.

Indiana Statement Of Benefits Personal Property 51764 Step 2: In the first half of section two, give the name of the designating body in charge of the area, the resolution number of your project, the location of the property and its county and its taxing district number.

Indiana Statement of Benefits Personal Property 51764 Step 3: The second half of section two, give a description of the manufacturing, information technology, logistical distribution and research and development equipment you plan to install. Give the proposed start and end dates for the installation of all these forms of technology.

Indiana Statement of Benefits Personal Property 51764 Step 4: In section three, give the current number of employees you have, their salaries, the number that will be retained for this project and their salaries, and the number of additional workers that will be hired and their salaries.

Indiana Statement of Benefits Personal Property 51764 Step 5: In section four, you must detail the total cost and assessed value of all manufacturing, research and development, logistical distribution and and information technology equipment that is to be installed. You must give the current values of all such equipment already installed, the estimated values of your proposed additions, the value of all property being replaced and the net estimated value of all equipment after completion of the project.

Indiana Statement of Benefits Personal Property 51764 Step 6: In section five, estimate the pounds of solid waste and hazardous waste that will be converted during the project. Write out any other benefits that can be expected.

Indiana Statement of Benefits Personal Property 51764 Step 7: The taxpayer or their authorized representative should sign and date section six, as well as providing their official title.

Indiana businesses which have projects in areas designated an Economic Revitalization Area may submit a form 51764 to obtain a property tax exemption on costs associated with these projects. The statement must be submitted prior to the installation of new equipment and approved if a deduction is to be obtained. The form is available on the website of the state of Indiana.

Indiana Statement Of Benefits Personal Property 51764 Step 1: In section one, give the name and address of the taxpayer, and the name and telephone number for a contact person.

Indiana Statement Of Benefits Personal Property 51764 Step 2: In the first half of section two, give the name of the designating body in charge of the area, the resolution number of your project, the location of the property and its county and its taxing district number.

Indiana Statement of Benefits Personal Property 51764 Step 3: The second half of section two, give a description of the manufacturing, information technology, logistical distribution and research and development equipment you plan to install. Give the proposed start and end dates for the installation of all these forms of technology.

Indiana Statement of Benefits Personal Property 51764 Step 4: In section three, give the current number of employees you have, their salaries, the number that will be retained for this project and their salaries, and the number of additional workers that will be hired and their salaries.

Indiana Statement of Benefits Personal Property 51764 Step 5: In section four, you must detail the total cost and assessed value of all manufacturing, research and development, logistical distribution and and information technology equipment that is to be installed. You must give the current values of all such equipment already installed, the estimated values of your proposed additions, the value of all property being replaced and the net estimated value of all equipment after completion of the project.

Indiana Statement of Benefits Personal Property 51764 Step 6: In section five, estimate the pounds of solid waste and hazardous waste that will be converted during the project. Write out any other benefits that can be expected.

Indiana Statement of Benefits Personal Property 51764 Step 7: The taxpayer or their authorized representative should sign and date section six, as well as providing their official title.