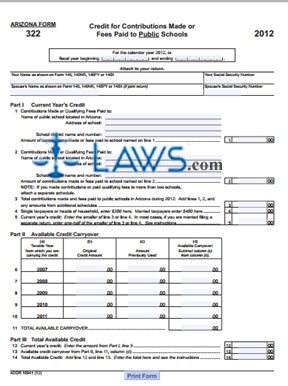

Form 322 Credit for Contributions Made or Fees Paid to Public Schools

INSTRUCTIONS: ARIZONA CREDIT FOR CONTRIBUTIONS MADE OR FEES PAID TO PUBLIC SCHOOLS (Form 322)

Form 322 is used to claim credit in Arizona for contributions made or fees paid to public schools. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 2: In the first blank box, enter your name as it appears on form 140, 140NR, 140PY or 140X.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 3: In the second blank box, enter your Social Security number.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 4: If filing jointly in the third blank box, enter your spouse's name as it appears on form 140, 140 NR, 140PY or 140X.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 5: If applicable, enter your spouse's Social Security number in the fourth blank box.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 6: Document qualifying contributions made or qualifying fees paid on lines 1a and 1b as instructed. If you require space to document additional contributions or fees, attach separate schedules as necessary. Enter the total of all such contributions on line 1c.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 7: If single or head of household, enter $200 on line 2. If married, enter $400 on line 2.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 8: Enter the smaller of line 1c or line 2 on line 3. If married and filing a separate return, enter half of the smaller of these two lines.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 9: Calculate your available credit carryover as directed on lines 4 through 9.

Arizona Credit For Contributions Made Or Fees Paid To Public Schools 322 Step 10: Calculate your total available credit as directed on lines 10 through 12.