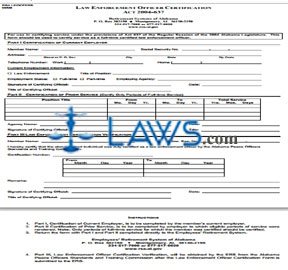

Law Enforcement Officer Certification

INSTRUCTIONS: ALABAMA LAW ENFORCEMENT OFFICER CERTIFICATION ACT 2004-637

Full-time law enforcement and corrections officers in Alabama who have not had a previous period of eligibility to purchase a hazardous duty service credit can do so by filing the form discussed in this article. It can be obtained from the website maintained by the Retirement Systems of Alabama.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 1: Part I is to be completed by your current employer. Your name is entered on the first line.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 2: Your Social Security number is entered on the second line.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 3: Your complete address is entered on the third line.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 4: Your work telephone number is entered on the fourth line, while your home telephone number is entered on the fifth line.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 5: The title of your current position is entered on the sixth line.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 6: Your employer should indicate with a check mark whether you are employed on a full-time or part-time basis.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 7: The title of your position is entered on the seventh line.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 8: The certifying official should enter their title and the date, as well as providing their signature.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 9: Part II is for the documentation of previous periods of eligible service completed as a full-time employee. This should be completed by the applicable employer. Your position title for each such position will be entered in the first column.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 10: The beginning date of each previous period of service will be entered in the second column.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 11: The ending date of each previous period of service will be entered in the third column.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 12: Your total length of service should be entered in the fourth column.

Alabama Law Enforcement Officer Certification Act 2004-637 Step 13: The certifying official should sign and date the form, as well as entering their title and the agency name. You may then file the form.