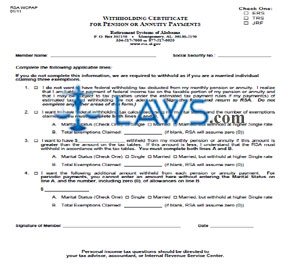

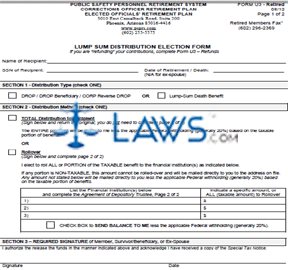

Withholding Certificate for Pension or Annuity Payments

INSTRUCTIONS: WITHHOLDING CERTIFICATE FOR PENSION OR ANNUITY PAYMENTS (Form W-4P)

All or a portion of your Arizona pension benefit may be considered federally taxable. You may complete a federal form W-4P to give the Arizona State Retirement System instructions on how to withhold federal taxes from your pension or annuity payments. This document can be obtained from the website maintained by the Internal Revenue Service.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 1: The top section of the form is a personal allowances worksheet to be completed for your records. Enter "1" for yourself if you cannot be claimed as a dependent by anyone else on line 1 and meet at least one of the three other listed requirements. If you meet another one, enter another "1" on line 2. You may enter the same figure for your spouse on line C.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 2: Enter the total number of dependents you will be claiming on line D, and enter "1" on line E if you will be filing as head of household.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 3: Line F concerns the child tax credit. Total lines A through F and enter the sum on line G.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 4: Detach the worksheet from the bottom half of the page along the line where indicated.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 5: On the first line of the form, enter your first name and middle initial, last name and Social Security number.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 6: On the next two lines, enter your full home address. On the right, enter your claim or identification number of your pension or annuity contract.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 7: Check line 1 if you do not wish to have federal income tax withheld from your pension or annuity. If so, do not complete the remainder of the form.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 8: Complete the Deductions and Adjustments Worksheet on the second page to complete line 2.

Withholding Certificate For Pension Or Annuity Payments W-4P Step 9: Complete the Multiple Pensions/More-Than-One-Income Worksheet on the second page to complete line 3.

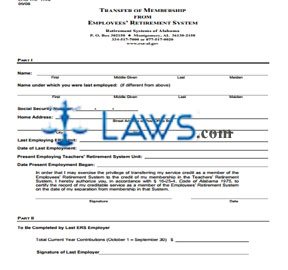

INSTRUCTIONS: ALABAMA TRANSFER OF MEMBERSHIP FROM EMPLOYEES' RETIREMENT SYSTEM

Alabama government employees who transition into a state teaching job may use the form discussed in this article to transfer their service credits from the Employees' Retirement System to the Teachers' Retirement System. This form can be found on the website of the Retirement Systems of Alabama.

Alabama Transfer Of Membership From Employees' Retirement System Step 1: On the first line, enter your first, middle and last name, as well as your maiden name if applicable.

Alabama Transfer Of Membership From Employees' Retirement System Step 2: If the name under which you were employed was different, enter your employment name on the second line.

Alabama Transfer Of Membership From Employees' Retirement System Step 3: On the third line, provide your Social Security number.

Alabama Transfer Of Membership From Employees' Retirement System Step 4: On the fourth line, provide your street address or post office box number.

Alabama Transfer Of Membership From Employees' Retirement System Step 5: On the fifth line, enter your city, state and zip code.

Alabama Transfer Of Membership From Employees' Retirement System Step 6: On the sixth line, enter the name of the last Employees' Retirement System unit which employed you.

Alabama Transfer Of Membership From Employees' Retirement System Step 7: On the seventh line, enter the date of your last employment with that unit.

Alabama Transfer Of Membership From Employees' Retirement System Step 8: On the eighth line, enter the date on which you began your current employment with your Teachers' Retirement System unit.

Alabama Transfer Of Membership From Employees' Retirement System Step 9: On the ninth line, enter the date on which your present employment began.

Alabama Transfer Of Membership From Employees' Retirement System Step 10: Sign and date Part I.

Alabama Transfer Of Membership From Employees' Retirement System Step 11: Part II at the bottom of the page is to be completed by your last Employees' Retirement System employer. They should enter your total current year contributions during the date range provided and provide their signature.

Alabama Transfer Of Membership From Employees' Retirement System Step 12: The form should be filed by mailing it to the address given at the top of the form. Those requiring additional assistance with completing this form can call the support telephone number provided there.

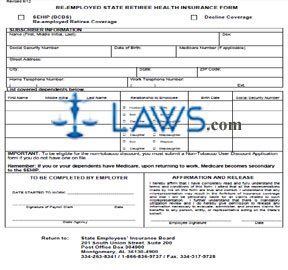

INSTRUCTIONS: ALABAMA RE-EMPLOYED STATE RETIREE HEALTH INSURANCE FORM (Form IB2)

Alabama retired public employees who become re-employed use the form discussed in this article to re-enroll in public employee health insurance or to decline coverage. This document can be obtained from the website maintained by the Alabama State Employees' Insurance Board.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 1: Indicate with a check mark whether you are seeking SEHIP coverage or declining coverage

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 2: Enter your first, middle and last name in the first blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 3: Enter your sex in the second blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 4: Enter your Social Security number in the third blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 5: Enter your date of birth in the fourth blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 6: Enter your Medicare number, if applicable, in the fifth blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 7: Enter your street address in the sixth blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 8: Enter your city in the seventh blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 9: Enter your state in the eighth blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 10: Enter your zip code in the ninth blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 11: Enter your home telephone number, including the area code, in the tenth blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 12: Enter your work telephone number, including the area code, in the eleventh blank box.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 13: If you have dependents, you must provide their full names, relationship to you, birth date and Social Security number in the table provided.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 14: Have your employer complete the bottom left section.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 15: Enter your signature and the date in the bottom right section.

Alabama Re-Employed State Retiree Health Insurance Form IB2 Step 16: Mail the form to the address given at the bottom of the page.

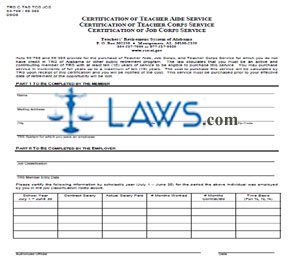

INSTRUCTIONS: ALABAMA CERTIFICATION OF TEACHER AIDE SERVICE CERTIFICATION OF TEACHER CORPS SERVICE CERTIFICATION OF JOB CORPS SERVICE (Form TRS C TAS TCS JCS)

Active and contributing members of the Alabama Teachers' Retirement System with 10 years of contributing membership can purchase credit for up to 10 years of service as a teacher aide, participant in the Teacher Corps program or as a participant in the Job Corps program. This is done using the certification form discussed in this article, which can be obtained from the website of the Retirement Systems of Alabama.

Alabama Certification Of Teacher Aide Service Certification Of Teacher Corps Service Certification Of Job Corps Service TRS C TAS TCS JCS Step 1: Part I should be completed by the member. Enter your name on the first blank line.

Alabama Certification Of Teacher Aide Service Certification Of Teacher Corps Service Certification Of Job Corps Service TRS C TAS TCS JCS Step 2: Enter your mailing street address or P.O. box number on the second blank line.

Alabama Certification Of Teacher Aide Service Certification Of Teacher Corps Service Certification Of Job Corps Service TRS C TAS TCS JCS Step 3: Enter your city, state and zip code on the third blank line.

Alabama Certification Of Teacher Aide Service Certification Of Teacher Corps Service Certification Of Job Corps Service TRS C TAS TCS JCS Step 4: On the fourth blank line, enter the TRS system for which you were an employee.

Alabama Certification Of Teacher Aide Service Certification Of Teacher Corps Service Certification Of Job Corps Service TRS C TAS TCS JCS Step 5: Part II should be completed by your employer. On the first blank line, they should enter your job classification.

Alabama Certification Of Teacher Aide Service Certification Of Teacher Corps Service Certification Of Job Corps Service TRS C TAS TCS JCS Step 6: On the second blank line, your employer should enter your TRS member entry date.

Alabama Certification Of Teacher Aide Service Certification Of Teacher Corps Service Certification Of Job Corps Service TRS C TAS TCS JCS Step 7: In the table provided, information should be provided about your salary and work hours.

Alabama Certification Of Teacher Aide Service Certification Of Teacher Corps Service Certification Of Job Corps Service TRS C TAS TCS JCS Step 8: The authorized official should sign and date the form.

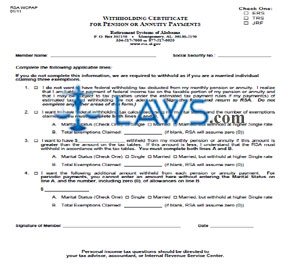

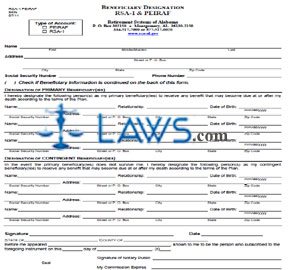

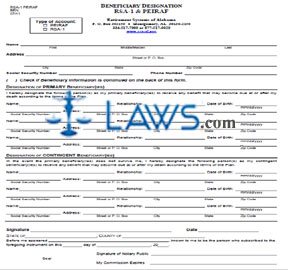

INSTRUCTIONS: ALABAMA BENEFICIARY DESIGNATION (Form RSA-1 PEIRAF)

Alabama public employees enrolled in the state-administered RSA-1 or PEIRAF retirement plans use the form discussed in this article to designate primary and contingent beneficiaries for their benefits in the event of their death. This document can be obtained from the website maintained by the Retirement Systems of Alabama.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 1: Indicate whether you maintain a PEIRAF or RSA-1 account with a check mark.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 2: On the first blank line, enter your first name, middle or maiden name and last name.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 3: On the second blank line, enter your street address or P.O. box number.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 4: On the third blank line, enter your city, state and zip code.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 5: On the fourth blank line, enter your Social Security number.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 6: On the fifth blank line, enter your phone number.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 7: If documenting additional primary or contingent beneficiaries on the second page, check the box where indicated. This will be the case if designating more than three primary or contingent beneficiaries.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 8: The first section concerns primary beneficiaries. For each, enter their name on the first blank line.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 9: For each beneficiary, enter their relationship to you on the second blank line.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 10: For each beneficiary, enter their date of birth on the third blank line.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 11: For each beneficiary, enter their street address or P.O. box number, city, state and zip code on the fourth blank line.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 12: The next section concerns contingent beneficiaries. For each one, provide their name, relationship to you, date of birth, Social Security number and complete address.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 13: If you require space to document additional primary or contingent beneficiaries, enter your name and Social Security number at the top of the second page and provide all additional information.

Alabama Beneficiary Designation RSA-1 PEIRAF Step 14: Sign and date the first page, then obtain the certification of a notary public.