Form TRS DODDSS Department of Defense Dependent School Service Purchase Information

INSTRUCTIONS: ALABAMA DEPARTMENT OF DEFENSE DEPENDENT SCHOOL SERVICE PURCHASE INFORMATION (Form TRS DODSS)

Active and contributing members of the Teachers' Retirement System of Alabama with a minimum of 10 years of service credit under this system may purchase credit for Department of Defense Dependent School Service. This article discusses two forms made available along with an instructional document used in this process, which can be found as one packet on the website maintained by the Retirement Systems of Alabama.

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 1: The first page is an informational document discussing the service credit purchase process.

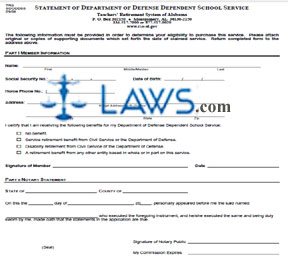

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 2: The second page contains a Statement Of Department Of Defense Dependent School Service (form TRS SDODDSS). The first section concerns the member. Enter your first name, middle or maiden name and last name on the first blank line.

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 3: Enter your Social Security number on the second blank line.

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 4: Enter your date of birth on the third blank line.

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 5: Enter your home phone number, including the area code, on the fourth blank line.

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 6: Enter your street address or P.O. box number on the fifth blank line.

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 7: Enter your city, state and zip code on the sixth blank line.

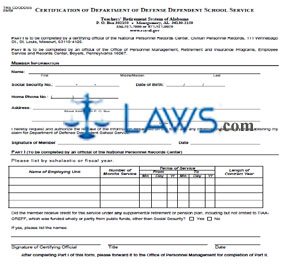

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 8: Part I must be completed by an official of the National Personnel Records Center. In the table provided, they must provide all information requested about your service.

Alabama Department Of Defense Dependent School Service Purchase Information TRS DODSS Step 9: The form should then be forwarded to the Office of Personnel Management for completion of Part II, which contains a questionnaire. An official of this office must answer the questions in this section by checking "Yes" or "No" as applicable, then signing and dating the bottom of the second page, as well as giving their title and the name of the retirement system.

Department of Defense Dependent School Service