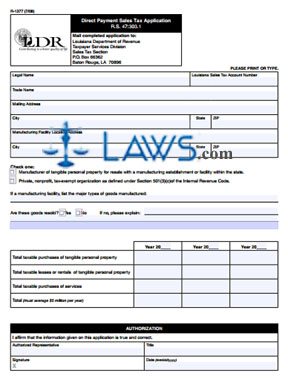

Form R-1377 Direct Payment Sales Tax Application

INSTRUCTIONS: LOUISIANA DIRECT PAYMENT SALES TAX APPLICATION (Form R-1377)

Louisiana manufacturers of tangible personal property made for the purposes of resale, as well as private non-profit organizations which have been classed by the IRS as 501(c)(3) entities, may file an application to pay sales tax owed directly to the government by filing a form R-1377. To qualify, they must average around $5 million owed in sales tax on an annual basis. This document can be found on the website of the Louisiana Department of Revenue.

Louisiana Direct Payment Sales Tax Application R-1377 Step 1: On the first line, give the legal name of your business and its sales tax account number.

Louisiana Direct Payment Sales Tax Application R-1377 Step 2: On the second line, give the trade name of your business

Louisiana Direct Payment Sales Tax Application R-1377 Step 3: On the third line, give your mailing address.

Louisiana Direct Payment Sales Tax Application R-1377 Step 4: On the fourth line, give your city, state and zip code.

Louisiana Direct Payment Sales Tax Application R-1377 Step 5: On the fifth line, give the address of your manufacturing facility. On the sixth line, give its city, state and zip code.

Louisiana Direct Payment Sales Tax Application R-1377 Step 6: Indicate with a check mark whether you are a manufacturer or a certified private non-profit organization.

Louisiana Direct Payment Sales Tax Application R-1377 Step 7: If you are a manufacturer, list the major types of goods you produce.

Louisiana Direct Payment Sales Tax Application R-1377 Step 8: Indicate with a check mark whether these goods are resold. If not, provide a written explanation.

Louisiana Direct Payment Sales Tax Application R-1377 Step 9: In the chart provided, enter your total taxable purchases of tangible personal property on the first line for up to three years.

Louisiana Direct Payment Sales Tax Application R-1377 Step 10: On the second line of the chart, enter your total taxable leases or rentals of tangible personal property.

Louisiana Direct Payment Sales Tax Application R-1377 Step 11: On the third line of the chart, enter the total of all taxable services purchased.

Louisiana Direct Payment Sales Tax Application R-1377 Step 12: On the last line of the chart, provide the total taxable amount.

Louisiana Direct Payment Sales Tax Application R-1377 Step 13: An authorized representative should sign and date the form and enter their title.