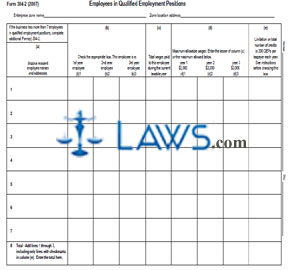

Form 304-2 Employees in Qualified Employment Positions

INSTRUCTIONS: ARIZONA EMPLOYEES IN QUALIFIED EMPLOYMENT POSITIONS (Form 304-2)

From 2004 to 2007, form 304-2 was used in Arizona document employees in qualified employment positions in an enterprise zone business. This form is no longer used but can still be obtained from the website of the Arizona Department of Revenue.

Arizona Employees In Qualified Employment Positions 304-2 Step 1: Enter the enterprise zone name on the first blank line.

Arizona Employees In Qualified Employment Positions 304-2 Step 2: Enter the zone location address on the second blank line.

Arizona Employees In Qualified Employment Positions 304-2 Step 3: In column a, enter the Arizona resident employee's names and addresses.

Arizona Employees In Qualified Employment Positions 304-2 Step 4: Enter your name and tax identification number on the right side of the table where indicated.

Arizona Employees In Qualified Employment Positions 304-2 Step 5: In column (b)1, enter a check mark if the employee is a first-year employee.

Arizona Employees In Qualified Employment Positions 304-2 Step 6: In column (b)2, enter a check mark if the employee is a second-year employee.

Arizona Employees In Qualified Employment Positions 304-2 Step 7: In column (b)3, enter a check mark if the employee is a second-year employee.

Arizona Employees In Qualified Employment Positions 304-2 Step 8: In column c, enter the total wages paid to the employee during the current taxable year.

Arizona Employees In Qualified Employment Positions 304-2 Step 9: Section d of the table concerns the maximum allowable wage. If the employee is a first-year employee, enter the value from column c or $2,000, whichever is lesser, in column (d)1.

Arizona Employees In Qualified Employment Positions 304-2 Step 10: If the employee is a second-year employee, enter the value from column c or $3,000, whichever is lesser, in column (d)2.

Arizona Employees In Qualified Employment Positions 304-2 Step 11: If the employee is a third-year employee, enter the value from column c or $3,000, whichever is lesser in column (d)3.

Arizona Employees In Qualified Employment Positions 304-2 Step 12: See the instructions before checking the box in column e for each employee.

Arizona Employees In Qualified Employment Positions 304-2 Step 13: Up to 7 employees can be documented on this table. If you have more employees in qualified employment positions, attach additional copies of form 304-2.