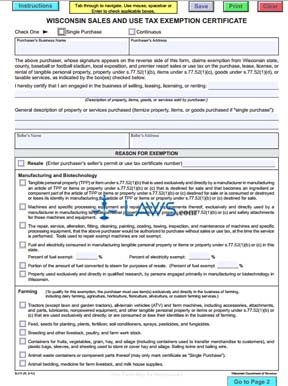

Form S-211 Wisconsin Sales and Use Tax Exemption Certificate and Instructions

INSTRUCTIONS: WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE (Form S-211)

Any Wisconsin organization which is exempt from sales and use tax should file a form S-2111 with any seller of goods or services when making a purchase. This document certifies their exemption status and should be maintained by the seller. The form can be found on the website of the Wisconsin Department of Revenue.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 1: At the top of the page, indicate whether this certificate is for a single purchase or is intended to apply to a continuous, ongoing business relationship.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 2: Give the business name and address of the purchaser.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 3: In the first blank line provided, give a description of the property, goods, items or services sold by the purchaser.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 4: In the next blank line provided, give a general description of the property or services purchased.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 5: Enter the name of the seller and their address.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 6: The rest of the form is used to indicate the basis for exemption. Check the box next to "resale" if items are being purchased for resale, licensing, leasing or rental.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 7: The next section concerns statements which apply to items purchased for manufacturing or biotechnology purposes. Check the box next to the statement which applies if applicable.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 8: The next section concerns items purchased for farming purchases.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 9: The first section on the second page concerns purchases made by federal or state government units.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 10: The next section lists other miscellaneous reasons for the exemption.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 11: The purchaser should sign and print their name at the bottom of the second page, as well as providing their title and the date.

Wisconsin Sales And Use Tax Exemption Certificate S-211 Step 12: The form should be filed with the seller within 90 days of the transaction.