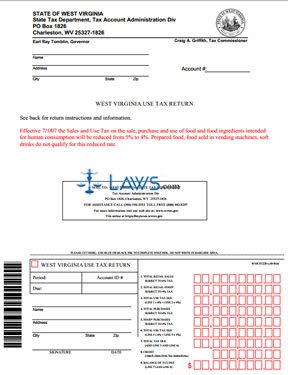

Forms CST-220 Use Tax Return

INSTRUCTIONS: WEST VIRGINIA USE TAX RETURN (Form CST220)

West Virginia businesses are required to pay a use tax on any items they purchased from out-of-state merchants which they did not pay state tax on. This article discusses form CST220, which is for use for period prior to October 1, 2008.

West Virginia Use Tax Return CST220 Step 1: Detach the bottom of the page along the line where indicated.

West Virginia Use Tax Return CST220 Step 2: Enter the period for which you are filing, your account identification number and the due date for your return.

West Virginia Use Tax Return CST220 Step 3: Enter your name and address. Sign and date the form.

West Virginia Use Tax Return CST220 Step 4: On line one, enter the total of retail sales other than that of food which are subject to the 6% use tax.

West Virginia Use Tax Return CST220 Step 5: On line two, enter the total retail sales of food subject to a 4% use tax rate.

West Virginia Use Tax Return CST220 Step 6: Multiply line one by 6%. Multiply line two by 4%. Add the two numbers and enter the sum on line 3 to determine your total use tax due.

West Virginia Use Tax Return CST220 Step 7: On line four, enter the total of all purchases subject to the 6% use tax.

West Virginia Use Tax Return CST220 Step 8: On line five, enter the total of all food purchases subject to the 4% use tax.

West Virginia Use Tax Return CST220 Step 9: Multiply line four by 6% and line five by 4%. Add the resulting numbers and enter the sum on line 6.

West Virginia Use Tax Return CST220 Step 10: Add lines 3 and 6. Enter the total on line 7.

West Virginia Use Tax Return CST220 Step 11: If you are claiming any tax credit for paying a vendor on exempt purchases, attach form CST-240. If you are claiming a credit for a tax paid directly to the state, attach form CST-AF2. Enter the sum of the credit being claimed on line 8.

West Virginia Use Tax Return CST220 Step 12: Subtract line 8 from line 7 to determine the balance of tax due. Enter this sum on line 9.