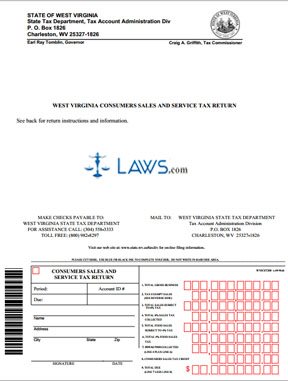

Form CST-200 Consumer Sales and Service Tax Return

INSTRUCTIONS: WEST VIRGINIA CONSUMER SALES AND SERVICE TAX RETURN (Form CST200)

West Virginia businesses must complete a form CST200 documenting how much consumer sales tax they owe. The form can be obtained from the website of the West Virginia State Tax Department.

West Virginia Consumer Sales And Service Tax Return CST200 Step 1: On the front of the page, enter the date of the period you are filing for, your account identification number, and the due date of this return.

West Virginia Consumer Sales And Service Tax Return CST200 Step 2: Below this, enter your name and address. Sign and date the form.

West Virginia Consumer Sales And Service Tax Return CST200 Step 3: On line one on the right, enter your gross total business sales. Do not include sales tax.

West Virginia Consumer Sales And Service Tax Return CST200 Step 4: On line two, give the total of all tax exempt sales if any. These must be documented on the back of the page under the section headed "Explanation of Tax Exempt Sales." You must enter the total of all sales for resale, sales of non-taxable services, sales to agricultural producers, sales to governmental entities, sales to persons presenting a direct day permit, sales of prescription drugs and the total of all other legally exempt sales.

West Virginia Consumer Sales And Service Tax Return CST200 Step 5: On line three, enter the total of all sales subject to the state's 6% sales tax. This includes sales of generally all products except for food which is not heated or prepared by the seller, which is documented on line five.

West Virginia Consumer Sales And Service Tax Return CST200 Step 6: On line four, enter the total of all 6% sales tax collected.

West Virginia Consumer Sales And Service Tax Return CST200 Step 7: On line five, enter the total of all food sales subject to the 4% state sales tax.

West Virginia Consumer Sales And Service Tax Return CST200 Step 8: On line six, enter the total 4% sales tax collected on all such food purposes

West Virginia Consumer Sales And Service Tax Return CST200 Step 9: Add lines four and six. Enter the total on line seven. Enter your consumer sales tax credit paid on exempt purchases on line eight and attach form CST240. Subtract line eight from line seven to determine your total due on line nine.