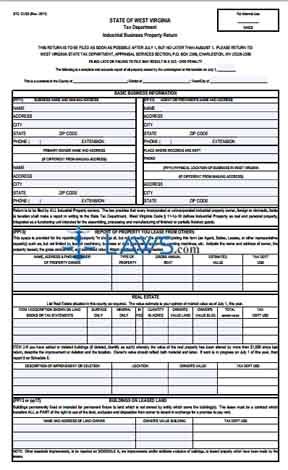

Form STC-1232I Industrial Business Property Return

INSTRUCTIONS: WEST VIRGINIA INDUSTRIAL BUSINESS PROPERTY RETURN (Form STC 12:321)

All West Virginia industrial property owners must submit a form STC 12:321 on an annual basis. This document serves as a declaration of all property which they possess related to their business. The form is found on the website of the website of the state of West Virginia.

West Virginia Industrial Business Property Return STC 12:321 Step 1: Enter the year at the top of the page, as well as the applicable county, district and city.

West Virginia Industrial Business Property Return STC 12:321 Step 2: Under the section "Basic Business Information," give all information requested about the mailing address and physical location of your business, the primary owner's name and address if different, and the name and address of any agent or preparer who completed this form.

West Virginia Industrial Business Property Return STC 12:321 Step 3: Under "Report of Property You Lease From Others," detail all machinery, vending machines and similar assets leased from others.

West Virginia Industrial Business Property Return STC 12:321 Step 4: Under "Real Estate," give all information requested about industrial buildings you own. Include your estimation of their current fair market value.

West Virginia Industrial Business Property Return STC 12:321 Step 5: The next section asks you to detail buildings on leased land. Include the name and address of the land owner.

West Virginia Industrial Business Property Return STC 12:321 Step 6: The second page asks you to detail all equipment and property improvements from the last year.

West Virginia Industrial Business Property Return STC 12:321 Step 7: The third page requires you to detail inventory supplies, machinery and tools which are in the process of being installed, other personal property such as storage buildings, incomplete construction projects, machinery which has been fully depreciated and is no longer in use (known as "salvage value machinery"), pollution control facilities, and molds, jigs and similar assets.

West Virginia Industrial Business Property Return STC 12:321 Step 8: The top half of the last page requires you to detail all motor vehicles associated with your business.

West Virginia Industrial Business Property Return STC 12:321 Step 9: The bottom of the last page asks for basic identifying information about your business.

West Virginia Industrial Business Property Return STC 12:321 Step 10: Sign and date the form.