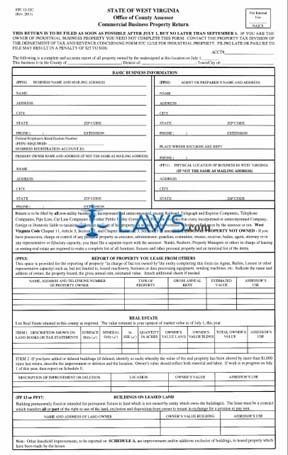

Form STC-1232C Commercial Business Property Return

INSTRUCTIONS: WEST VIRGINIA COMMERCIAL BUSINESS PROPERTY RETURN (Form STC 12:32C)

Most non-utility West Virginia business owners, whether incorporated or unincorporated, must file an annual property return noting all property associated with their company. This form STC 12:32C can be found on the website of the form of the state of West Virginia. This should not be confused with the form filed to document industrial property, which is form STC 12:31C.

West Virginia Commercial Business Property Return STC 12:32C Step 1: Where indicated at the top of the page, give your account number and location of your business.

West Virginia Commercial Business Property Return STC 12:32C Step 2: The section "Basic Business Information" requires basic information about the owners, agents and location of your business.

West Virginia Commercial Business Property Return STC 12:32C Step 3: The section "Property You Lease From Others" requires that you give the name, address and telephone number of all property owners you lease from. Note the type of property, your gross annual rent and the estimated value of the property. The next section, "Real Estate," concerns your own property. Include your estimation of the current fair market price. The next section, "Buildings on Leased Land," requires the name and address of the land's property owners, and the value of the building itself.

West Virginia Commercial Business Property Return STC 12:32C Step 4: Page two requires you to detail all improvements made to machinery, equipment, furniture, fixtures, leaseholds and computer equipment.

West Virginia Commercial Business Property Return STC 12:32C Step 5: The first section on page three requires you to detail your inventory, parts and supplies.

West Virginia Commercial Business Property Return STC 12:32C Step 6: The next section on page three requires you to detail machinery and tools which are being installed.

West Virginia Commercial Business Property Return STC 12:32C Step 7: The next section concerns "Other Personal Property," such as storage buildings. Below this, detail all motor vehicles and mobile homes where indicated. At the bottom of the page, note any sheep and goats of breeding age your business has.

West Virginia Commercial Business Property Return STC 12:32C Step 8: The last page concerns incomplete construction projects, fully depreciated machinery, pollution control facilities and other identifying information about your business. Sign and date the bottom.