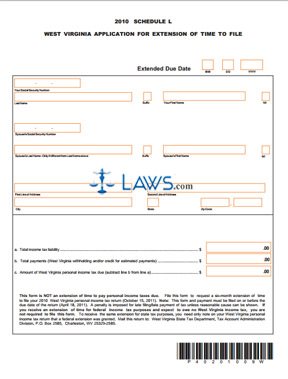

Form Schedule L Application for Extension of Time to File

INSTRUCTIONS: SCHEDULE L WEST VIRGINIA APPLICATION FOR EXTENSION OF TIME TO FILE

Individuals or spouses filing tax returns jointly in the state of West Virginia can apply for an extension for more time to file their return with the state. This document does not grant you an extension on the amount of time to pay your taxes. Payment must be submitted with this form. The form is available on the official website of the state of West Virginia. This article discusses the form for the 2010 tax year, but its content is not different from other years. The document must be filed on or before the tax payment due date.

Schedule L West Virginia Application For Extension Of Time To File Step 1: Enter the extended due date (six months from the time of filing) you are seeking at the top right of the page where indicated.

Schedule L West Virginia Application For Extension Of Time To File Step 2: Enter your Social Security number where indicated.

Schedule L West Virginia Application For Extension Of Time To File Step 3: Enter your last name, any suffix, first name and middle initial where indicated.

Schedule L West Virginia Application For Extension Of Time To File Step 4: Enter your spouse's Social Security number where indicated, if applicable.

Schedule L West Virginia Application For Extension Of Time To File Step 5: If you are filing jointly, only give the last name of your spouse if it is different from yours. Also enter their suffix (if applicable), first name and middle initial. Enter your full address where indicated, including your city, state and zip code.

Schedule L West Virginia Application For Extension Of Time To File Step 6: On line a, enter your total income tax liability rounded to the nearest whole dollar.

Schedule L West Virginia Application For Extension Of Time To File Step 7: On line b, enter the sum of all West Virginia taxes withheld from your wages and any credit for estimated payments made already.

Schedule L West Virginia Application For Extension Of Time To File Step 8: Subtract line b from line a to determine how much tax is due. Enter this on line c.

Schedule L West Virginia Application For Extension Of Time To File Step 9: Submit the form with a check or money order to the address on the bottom of the page.