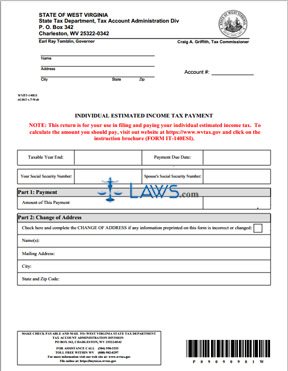

Form IT-140ES Individual Estimated Income Tax Payment

INSTRUCTIONS: WEST VIRGINIA INDIVIDUAL ESTIMATED INCOME TAX PAYMENT (Form IT-140ES)

If you expect to $600 or more to the state of West Virginia in income taxes, you must file an estimated income tax payment. This is done using a form IT-140ES, which is found on the website of the West Virginia State Tax Department.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 1: On the first blank line at the top left-hand side of the page, enter your name.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 2: On the second blank line, enter your street address.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 3: On the third blank line, enter your city, state and zip code.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 4: In the blank line on the right, enter your state tax account number.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 5: On the next blank line, enter your taxable year end date and your payment due date.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 6: On the next blank line, enter your Social Security number. If filing taxes jointly with a spouse, enter their Social Security number as well.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 7: On the next blank line, under "Part 1," enter the amount of the payment enclosed with this document. To estimate your tax owed, you should use instruction booklet IT-140ESI, available at the website of the West Virginia State Tax Department.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 8: "Part 2" is only to be completed if name and address information given on a preprinted label is either inaccurate or has changed. If so, check the box where indicated and enter your new name and address in this section.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 9: Make your check payable to "West Virginia State Tax Department." You must pay at least the minimum indicated by the instructions to avoid a penalty fee.

West Virginia Individual Estimated Income Tax Payment IT-140ES Step 10: Mail the return and your check to the mailing address given at the bottom of the page. You may also file your return online at the URL given on the form.