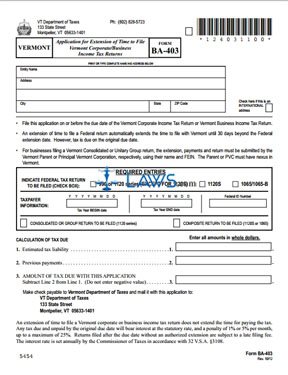

Form BA-403 Extension of Time Application

INSTRUCTIONS: APPLICATION FOR EXTENSION OF TIME TO FILE VERMONT CORPORATE/BUSINESS INCOME TAX RETURNS (Form BA-403)

Corporations and businesses operating in Vermont which need additional time to file their state income tax returns can apply for an extension using a form BA-403. This document can be obtained from the website of the Vermont Department of Taxes.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 1: On the first line of the table, enter your entity name.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 2: On the second and third lines of the table, enter your street address.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 3: On the fourth line, enter your city, state and zip code. Check the box on the right if this is an international return.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 4: Indicate the type of federal return you file with a check mark.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 5: Enter the beginning and ending dates of your filing year and your federal identification number.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 6: If you are going to file a consolidated or group return or a composite return, indicate this with a check mark.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 7: On line one, enter your estimated tax liability in whole dollars.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 8: On line two, enter your previous payments.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 9: Subtract line two from line one. Enter the resulting difference on line three. This is the amount of tax due with this application.

Application For Extension Of Time To File Vermont Corporate/Business Income Tax Returns BA-403 Step 10: An officer or their authorized agent should sign and print their name, as well as entering the date. Electing to include a daytime telephone contact phone number is optional.