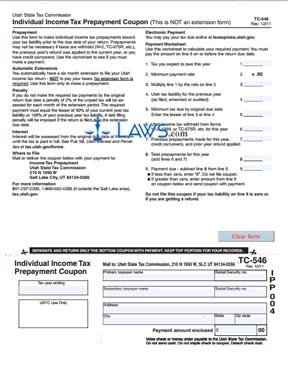

Form TC-546 Individual Income Tax Prepayment Coupon

INSTRUCTIONS: UTAH INDIVIDUAL INCOME TAX PREPAYMENT COUPON (Form TC-546)

Utah residents may prepay part of their state income tax before filing their official tax return. To do so, you will need to complete a form TC-546 and submit it along with your payment. This coupon document is found on the website of the Utah State Tax Commission. You may make your payment online or submit a check or money order with this coupon.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 1: The top of the page is a worksheet to be saved for your records. Separate this part of the form from the bottom half along the dotted line where indicated. Do not submit this with your coupon.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 2: On line one of this worksheet, enter the amount of tax you expect to pay this year.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 3: Line two gives the minimum payment rate of 90%. Multiply .9 by line one and enter the result on line three.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 4: On line four, give your Utah tax liability for the previous year.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 5: On line five, give the minimum tax due by the original due date. This is the lesser of the two numbers entered on lines three and four.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 6: On line six, give all Utah income tax withheld as recorded on forms W-2, 1099 or TC-675R.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 7: On line seven, total all previous prepayments, credit carryovers and the previous year's refund. Total lines six and seven and enter the sum on line eight.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 8: Subtract line eight from line five to determine the payment due.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 9: On the actual coupon portion of the page, enter the tax year for which you are filing.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 10: Enter your name and Social Security number. Enter the same information for your spouse if applicable. Give your full address and note how much you are paying.

Utah Individual Income Tax Prepayment Coupon TC-546 Step 11: If sending a check or money order, make it payable to the Utah Tax Commission.