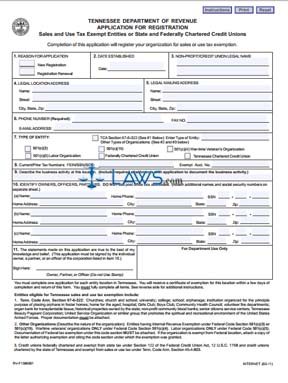

Form Application for Sales and Use Tax Exempt Entities or State and Federally Chartered Credit Unions

INSTRUCTIONS: TENNESSEE APPLICATION FOR REGISTRATION SALES AND USE TAX EXEMPT ENTITIES

Tennessee organizations which are qualified as nonprofit organizations exempt from federal tax, as well as those which meet certain qualifications listed on the instructions, should file an application to register themselves as exempt from sales and use tax with the state's Department of Revenue. This document should also be filed to renew your exemption status. The form is found on the website of the government of Tennessee.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 1: In section one, indicate with a check mark if you are filing a new application or renewing your registration.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 2: In section two, give the date your organization was established.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 3: In section three, give the name of your non-profit's legal name.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 4: In section four, give your legal mailing address.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 5: In section five, you are required to provide a phone number. Including your fax number or email address is optional.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 6: In section six, indicate with a check mark if you are a non-profit organization or place a check mark next to the IRS code number classifying your business.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 7: In section seven, give your federal employer identification number, Social Security number, or the number assigned by the secretary of state. Enter your exempt account number.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 8: In section eight, give a written description of your business activities.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 9: In section nine, give the names, home phone numbers, Social Security numbers and home addresses of all owners, officers and partners.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 10: An owner, partner or officer should sign section ten.

Tennessee Application For Registration Sales And Use Tax Exempt Entities Step 11: Submit the form along with all listed required supporting documents to the mailing address given in the instructions.