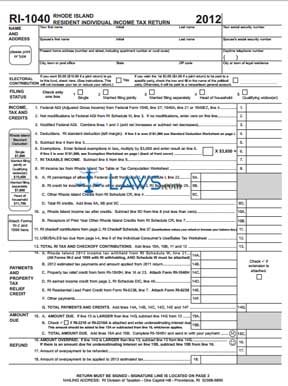

Form RI-1040 Resident Individual Income Tax Return

INSTRUCTIONS: RHODE ISLAND RESIDENT INDIVIDUAL INCOME TAX RETURN (Form RI-1040)

Rhode Island residents use a form RI-1040 to document and file their state income tax owed. The form is found on the website of the Rhode Island Division of Taxation.

Rhode Island Resident Individual Income Tax Return RI-1040 Step 1: Enter your name and Social Security number, as well as that of your spouse if filing jointly. Enter your address and a daytime telephone number.

Rhode Island Resident Individual Income Tax Return RI-1040 Step 2: If you wish to make an electoral contribution, indicate this with a check mark.

Rhode Island Resident Individual Income Tax Return RI-1040 Step 3: Indicate with a check mark whether you are filing as a single individual, married filing jointly or separately, as head of household or as a qualifying widow(er).

Rhode Island Resident Individual Income Tax Return RI-1040 Step 4: Enter your federal adjusted gross income on line 1. Modifications should be computed on a separate Schedule M and entered on line 2. The sum of these two lines is entered on line 3.

Rhode Island Resident Individual Income Tax Return RI-1040 Step 5: Enter your standard deduction as tied to your filing status and indicated in the chart on the left on line 4. Subtract this from line 3 and enter the difference on line 5. Federal exemptions should be multiplied by $3,500 and the resulting product entered on line 6, then subtracted from line 5 to determine your taxable income on line 7.

Rhode Island Resident Individual Income Tax Return RI-1040 Step 6: Consult a Rhode Island Tax Table or Tax Computation Worksheet to determine your income tax on line 8. To complete line 9, you must complete schedules I and II on the next page, as well as the separately provided Schedule CR. The total tax credits on line 9D are subtracted from line 8 to determine your income tax owed after credits on line 10.

Rhode Island Resident Individual Income Tax Return RI-1040 Step 7: Complete the Checkoff Schedule on the second page to complete line 11.

Rhode Island Resident Individual Income Tax Return RI-1040 Step 8: Follow instructions to complete lines 12 through 15 to determine your amount owed. If you are owed a refund, complete lines 16 through 18. Sign and date the bottom of the second page.