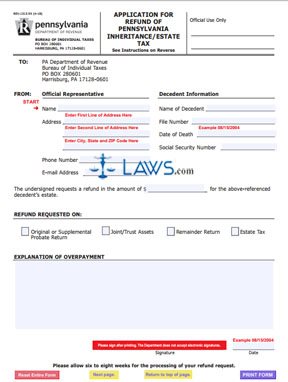

Form REV-1313 Application for Refund of Pennsylvania Inheritance Estate Tax

INSTRUCTIONS: APPLICATION FOR REFUND OF PENNSYLVANIA INHERITANCE/ESTATE TAX (Form REV-1313)

When someone involved in the management and disbursement of an estate has overpaid estate or income tax in the state of Pennsylvania, they may request a refund using form REV-1313. This document can be found on the website of the Commonwealth of Pennsylvania's Enterprise Portal, which maintains official government documents used in the state.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 1: On the left side of the page, the official representative should enter their name. This official representative must be either the person who paid the tax, their assignee, the estate's executor or administrator, or the attorney for the estate. No one else is legally permitted to complete and sign this document.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 2: Enter the address of the personal representative.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 3: Enter the phone number of the personal representative.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 4: Enter the email address of the personal representative.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 5: On the right side of the form, enter the name of the decedent on the first line.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 6: On the second line, enter the file number assigned to the estate or case.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 7: On the third line, enter the date of death.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 8: On the fourth line, enter the decedent's Social Security number.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 9: In the blank space provided below, enter the requested amount of the refund.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 10: Four types of refunds can be requested. Check the applicable box next to "Original or Supplemental Probate Return," "Joint/Trust Assets," "Remainder Return" or "Estate Tax."

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 11: Provide a written explanation of the basis of your request for a refund in the space provided.

Application For Refund Of Pennsylvania Inheritance/Estate Tax REV-1313 Step 12: Sign and date the bottom of the first page. Mail the document to the address at the top left-hand corner.