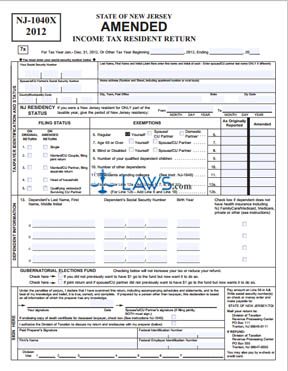

Form NJ-1040X New Jersey Amended Income Tax Resident Return

INSTRUCTIONS: NEW JERSEY AMENDED INCOME TAX RESIDENT RETURN (Form NJ-1040X 2011)

If you must correct or amend any information given on a form NJ-1040 document your New Jersey resident income tax return, you should use a form NJ-1040X. This document can be found on the website of the state of New Jersey.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 1: At the top of the form, enter your name, address and Social Security number. If you have filed your taxes jointly with your spouse, you must provide their name and Social Security number as well.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 2: If you were only a part-year New Jersey resident, give the dates of your residency where indicated.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 3: Indicate your filing status, both as filed and as applicable on this amended document.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 4: Lines 6 through 12 concern exemptions claimed, both as originally reported and as amended.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 5: On line 13, list all dependents. Give their name, Social Security number and birth year. Check the box if any of them do not have health insurance.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 6: At the top of the second page, enter your name or names and Social Security number again.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 7: Lines 14 through 28 concern your total taxable income. Enter all information requested as originally reported in first column and as amended in the second column.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 8: Lines 29 through 36c provide instructions for calculating exemptions and deductions.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 9: Lines 37 through 40 recalculate your tax due based on tax paid to other jurisdictions.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 10: Lines 41 through 59 offer instructions for the final calculations to be made regarding credits, under or over payments made and penalties due.

New Jersey Amended Income Tax Resident Return NJ-1040X 2011 Step 11: Where indicated, provide a written explanation of what information has changed, including the line numbers. Sign and date the first page.