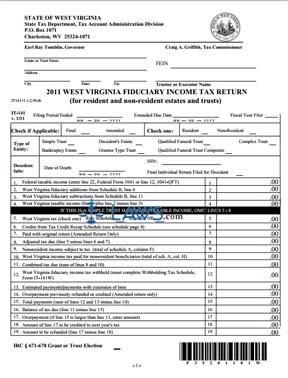

Form IT14111 Fiduciary Income Tax Return

INSTRUCTIONS: WEST VIRGINIA FIDUCIARY INCOME TAX RETURN (Form IT-141)

West Virginia estates or trusts managed by residents or non-residents document their income tax due with a form IT-141. This document is found on the website of the government of West Virginia.

West Virginia Fiduciary Income Tax Return IT-141 Step 1: At the top left of the form, enter the name of the trust and estate and its address.

West Virginia Fiduciary Income Tax Return IT-141 Step 2: At the right, enter its Federal Employer Identification Number and the name of the trustee or executor.

West Virginia Fiduciary Income Tax Return IT-141 Step 3: Below, enter the end date of the financial period in question and, if applicable, your extended due date.

West Virginia Fiduciary Income Tax Return IT-141 Step 4: Indicate with a check mark what type of entity this form concerns.

West Virginia Fiduciary Income Tax Return IT-141 Step 5: Give the date of the death of the decedent, their Social Security number, and the date on which their final individual return was filed.

West Virginia Fiduciary Income Tax Return IT-141 Step 6: Lines 1 through 4 provide instructions for computing total taxable income. To determine your total additions, complete lines 1 through 6 of Schedule B on the second page and transfer the result to line 2 on the first page. To determine your total subtractions, complete lines 7 through 12 on Schedule B and transfer the result to line 3 on the first page.

West Virginia Fiduciary Income Tax Return IT-141 Step 7: Lines 5 through 8 may be skipped by simple trusts. Otherwise, complete these lines to determine adjusted tax due.

West Virginia Fiduciary Income Tax Return IT-141 Step 8: Non-residents must skip to Schedule A on the third page before they will be able to complete lines 9 and 10. If you are a resident, skip these lines.

West Virginia Fiduciary Income Tax Return IT-141 Step 9: Add lines 8 and 10 and enter the sum on line 11. This is your combined tax due.

West Virginia Fiduciary Income Tax Return IT-141 Step 10: Lines 12 through 19 provide instructions for computation of the tax balance due after payments already made have been taken into consideration, as well as the amount of the refund due if you have overpaid.

West Virginia Fiduciary Income Tax Return IT-141 Step 11: Sign and date the second page.