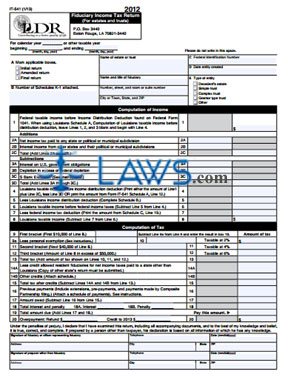

Form IT-541 Fiduciary Income Tax Return

INSTRUCTIONS: LOUISIANA FIDUCIARY INCOME TAX RETURN (Form IT-541)

Louisiana estates and trusts should pay their income taxes using a form IT-541. This document can be obtained from the website of the Louisiana Department of Revenue.

Louisiana Fiduciary Income Tax Return IT-541 Step 1: Enter the calendar year you are filing for. If filing on a fiscal year basis, enter your starting and ending dates.

Louisiana Fiduciary Income Tax Return IT-541 Step 2: Indicate with a check mark if you are filing an initial, amended or final return and indicate the number of schedule K-1s which are attached.

Louisiana Fiduciary Income Tax Return IT-541 Step 3: Give the name of the estate or trust, the name and title of the fiduciary, and their address.

Louisiana Fiduciary Income Tax Return IT-541 Step 4: Give the federal identification number of the estate or trust, the date on which it was created, and indicate the type of estate or trust with a check mark.

Louisiana Fiduciary Income Tax Return IT-541 Step 5: On line 1, enter the federal taxable income before income distribution deduction. If you are using Schedule A to compute this, skip lines 1 through 3 and begin on line 4.

Louisiana Fiduciary Income Tax Return IT-541 Step 6: Document your additions on lines 2A through 2C and your subtractions on lines 3A through 3D if not completing Schedule A.

Louisiana Fiduciary Income Tax Return IT-541 Step 7: Complete line 4 as instructed, then skip to the second page and complete Schedule B. Transfer the result from there to line 5.

Louisiana Fiduciary Income Tax Return IT-541 Step 8: Subtract line 5 from line 4 and enter the difference on line 6.

Louisiana Fiduciary Income Tax Return IT-541 Step 9: Complete Schedule C and transfer the result from line 19 there to line 7 on the first page.

Louisiana Fiduciary Income Tax Return IT-541 Step 10: Subtract line 7 from line 6 to calculate your taxable income on line 8.

Louisiana Fiduciary Income Tax Return IT-541 Step 11: Follow the directions on lines 9 through 20 to compute your taxes due or refund owed.

Louisiana Fiduciary Income Tax Return IT-541 Step 12: The fiduciary or an officer representing them should sign the bottom of the first page, give their address and telephone number, and give the date.