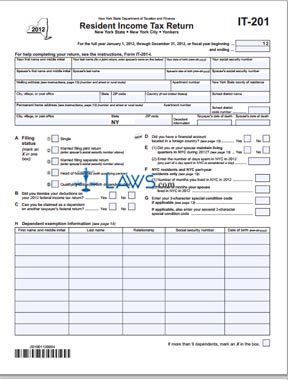

Form IT-201 Resident Income Tax Return

INSTRUCTIONS: NEW YORK RESIDENT INCOME TAX RETURN (Form IT-201)

New York residents file their state income tax due using a form IT-201. This document is obtained from the website of the New York State Department of Taxation and Finance.

New York Resident Income Tax Return IT-201 Step 1: Give your name, date of birth and Social Security number, as well as that of your spouse if filing your return jointly.

New York Resident Income Tax Return IT-201 Step 2: Enter your address, county and school district name and code number.

New York Resident Income Tax Return IT-201 Step 3: Indicate your filing status by making an "X" next to the applicable statement. Answer questions B, C and E in the same fashion.

New York Resident Income Tax Return IT-201 Step 4: Question F is only for New York City full-time and part-year residents.

New York Resident Income Tax Return IT-201 Step 5: Question G is only for those with a special condition.

New York Resident Income Tax Return IT-201 Step 6: Lines 1 through 19 require you to calculate and detail your federal adjusted gross income.

New York Resident Income Tax Return IT-201 Step 7: Lines 20 through 24 concern New York additions.

New York Resident Income Tax Return IT-201 Step 8: Lines 25 through 33 concern New York subtractions.

New York Resident Income Tax Return IT-201 Step 9: Lines 34 through 37 concern deductions. You may claim a standard deduction by consulting the chart at the bottom left of the page. If you wish to claim an itemized deduction, you must complete the worksheet at the bottom right of the page.

New York Resident Income Tax Return IT-201 Step 10: Lines 38 through 46 provide instructions for computing your total state taxes due.

New York Resident Income Tax Return IT-201 Step 11: Lines 47 through 58 are only for New York City and Yonkers residents.

New York Resident Income Tax Return IT-201 Step 12: Line 59 concerns the computation of sales and use tax owed.

New York Resident Income Tax Return IT-201 Step 13: Lines 60 and 61 concern voluntary contributions.

New York Resident Income Tax Return IT-201 Step 14: Lines 63 through 81 contain instructions for the final calculations to determine your tax owed, as well as any refund you may be owed by the state. Sign and date the form.