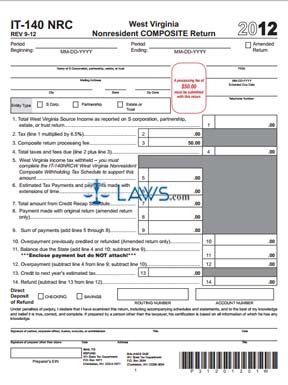

Form IT-140 NRC Nonresident Composite Return

INSTRUCTIONS: WEST VIRGINIA NONRESIDENT COMPOSITE RETURN (Form IT-140 NRC)

Nonresidents of West Virginia who derive income from a partnership, S-corporation, estate or trust whose income comes from sources in the state can file a composite return to document all such sources. This document is found on the website of the state government of West Virginia.

West Virginia Nonresident Composite Return IT-140 NRC Step 1: At the top of the page, enter the starting and ending dates of the period in question.

West Virginia Nonresident Composite Return IT-140 NRC Step 2: Indicate with a check mark if you are filing an amended return.

West Virginia Nonresident Composite Return IT-140 NRC Step 3: Give the name, telephone number and mailing address of the S corporation, partnership, estate or trust in question.

West Virginia Nonresident Composite Return IT-140 NRC Step 4: Give that entity's Federal Employer Identification Number. If you have been granted a filing extension, enter your extended due date.

West Virginia Nonresident Composite Return IT-140 NRC Step 5: Indicate with a check mark what type of entity you are filing in regards to.

West Virginia Nonresident Composite Return IT-140 NRC Step 6: Enter the total source income on line 1. Multiply this by 6.5% to determine the tax due. Enter this product on line 2.

West Virginia Nonresident Composite Return IT-140 NRC Step 7: Add $50 as noted on line 3. Enter the sum on line 4.

West Virginia Nonresident Composite Return IT-140 NRC Step 8: Skip to the withholding tax schedule on the third page, also known as form IT-140 NRC-W. Give the name of the employer or payer and their address in column A. Enter the name and address of the employee or taxpayer in column B. Enter all taxes withheld in column C. Transfer the total from column C to line 5 on the first page.

West Virginia Nonresident Composite Return IT-140 NRC Step 9: Detail and total payments already made on lines 6 through 9.

West Virginia Nonresident Composite Return IT-140 NRC Step 10: Line 10 is only for those filing an amended return.

West Virginia Nonresident Composite Return IT-140 NRC Step 11: Follow instructions to complete lines 11 through 14 to determine your refund due. Indicate with a check mark whether you wish for this to be deposited into a checking or savings account. If so, give the account and routing numbers.