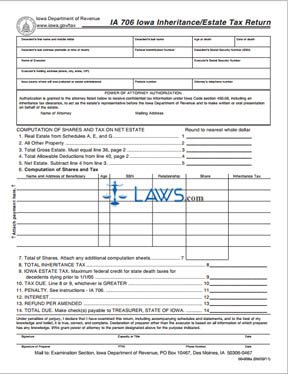

Form IA 706 Iowa Inheritance Estate Tax Return

INSTRUCTIONS: IOWA INHERITANCE/ESTATE TAX RETURN (Form IA 706)

To pay inheritance and estate tax in the state of Iowa, file a form IA 706. This document is found on the website of the government of Iowa.

Iowa Inheritance/Estate Tax Return IA 706 Step 1: Enter the decedent's name, date of death, age at the time, their address at the time of death, and federal identification and Social Security numbers.

Iowa Inheritance/Estate Tax Return IA 706 Step 2: Enter the executor's name, Social Security number, mailing address, the Iowa county where the will was probated or the estate was administered, the probate number if applicable, and the responsible attorney's phone number.

Iowa Inheritance/Estate Tax Return IA 706 Step 3: If you wish to authorize an attorney to receive confidential tax information regarding the estate and to act as a representative in all related matters, give their name and mailing address.

Iowa Inheritance/Estate Tax Return IA 706 Step 4: Complete the separate schedules A, E and G to determine the total value of all real estate. Enter this on line 1.

Iowa Inheritance/Estate Tax Return IA 706 Step 5: Enter the total value of all other property on line 2.

Iowa Inheritance/Estate Tax Return IA 706 Step 6: Skip to the second page and complete the section labeled "Summary of Gross Estate." Transfer the total value on line 36 to line 3 on the first page.

Iowa Inheritance/Estate Tax Return IA 706 Step 7: Summarize your deductions on lines 37 through 40 as directed and transfer the total value to line 4 on the first page.

Iowa Inheritance/Estate Tax Return IA 706 Step 8: Subtract line 4 from line 3 and enter the difference on line 5.

Iowa Inheritance/Estate Tax Return IA 706 Step 9: In the chart provided on line 6, enter the name and address of every beneficiary, their age and Social Security number, their relationship to the decedent, their share of the estate and the inheritance tax they owe. Complete lines 7 through 14 as instructed to calculate the total tax due to the state or refund owed.

Iowa Inheritance/Estate Tax Return IA 706 Step 10: Sign and date the bottom of the first page and give your title. Document property located outside of the state in the chart at the bottom of the second page.