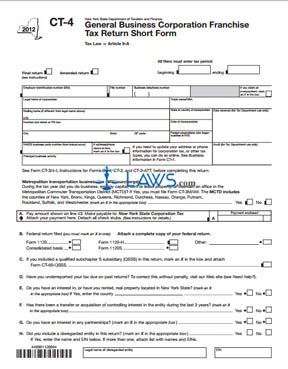

Form CT-4 General Business Corporation Franchise Tax Return Short Form

INSTRUCTIONS: NEW YORK GENERAL BUSINESS CORPORATION FRANCHISE TAX RETURN SHORT FORM (Form CT-4)

Corporations operating in New York may file their franchise taxes using a form CT-4. This document can be obtained from the website of the New York State Department of Taxation and Finance.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 1: Indicate with a check mark if this is a final or amended return.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 2: Enter the beginning and ending dates of your filing period.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 3: Enter your employer identification number, file number, and business telephone number.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 4: Enter the legal name of your corporation.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 5: Enter the mailing name of your corporation if different from your legal name, as well as your address.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 6: Enter the state or country of your incorporation, the date on which this occurred and (if a foreign corporation) the day you began operations in New York.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 7: Enter your NAICS business code and principal business activity.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 8: Complete lines B through H as directed.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 9: Lines 1 through 12 concern computation of your entire net income base.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 10: Lines 13 through 20 concern computation of your capital base.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 11: Lines 21 through 27 concern computation of your minimum taxable income base.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 12: Lines 28 through 48 concern computation of your tax owed or refund due.

New York General Business Corporation Franchise Tax Return Short Form CT-4 Step 13: Lines 49 through 54 concern composition of prepayments documented on line 35, Lines 55 through 59 concern interest paid to shareholders, and lines 60 through 72 are only for corporations organized outside New York State.