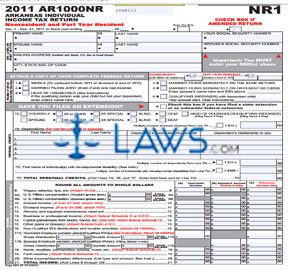

Form AR1000NR Individual Income Tax Return Non Resident

INSTRUCTIONS: ARKANSAS INDIVIDUAL INCOME TAX RETURN NONRESIDENT AND PART YEAR RESIDENT (Form AR1000NR)

Part year residents and non-residents who owe income tax to the state of Arkansas should file a form AR1000NR. This document is obtained from the website of the Arkansas Department of Finance and Administration.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 1: Give your fiscal year dates if not filing on a calendar year basis.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 2: Give your name and Social Security number, as well as that of your spouse if filing jointly. Enter your mailing address.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 3: Indicate your filing status with a check mark. Non-residents should enter their state of residence, while part year residents should give the dates they lived in the state. Indicate with a check mark if you have filed a state or automatic federal extension.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 4: Check the box next to all personal credits being claimed. In the table provided, give the names, Social Security numbers and relationship to you of all dependents.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 5: Three columns are provided to calculate your income on lines 8 through 24. Column A is for your single or joint federal income. If married and filing separately, Column B is for your spouse's federal income. In column C, you should enter your Arkansas income.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 6: Follow the directions on lines 25 through 31 to calculate your total tax liability.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 7: Lines 32 through 36 provide directions for calculating your net tax due.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 8: Lines 36A through 36D calculate your apportioned tax liability.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 9: Lines 37 through 44 document payments already made.

Arkansas Individual Income Tax Return Nonresident And Part Year Resident AR1000NR Step 10: Lines 45 through 51 provide the final calculations to determine your tax or refund owed. Sign and date the bottom of the form.