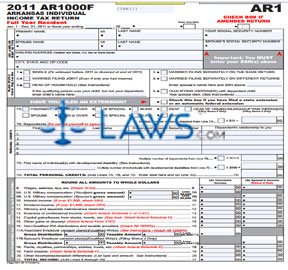

Form AR1000F Individual Income Tax Return

INSTRUCTIONS: ARKANSAS INDIVIDUAL INCOME TAX RETURN (Form AR1000F)

Full-year residents of Arkansas can use a long-form AR1000F to file their state income tax owed. This document is found on the website of the Arkansas Department of Finance and Administration.

Arkansas Individual Income Tax Return AR1000F Step 1: Give the ending date of your fiscal year if you do not file on a calendar year basis.

Arkansas Individual Income Tax Return AR1000F Step 2: Enter your name and Social Security number, as well as that of your spouse if filing jointly.

Arkansas Individual Income Tax Return AR1000F Step 3: Enter your mailing address.

Arkansas Individual Income Tax Return AR1000F Step 4: Indicate your filing status with a check mark. Check the box where indicated if you have filed a state or federal extension.

Arkansas Individual Income Tax Return AR1000F Step 5: Check the box next to all personal credits being claimed. List the names of all dependents and give their Social Security numbers and relationship to you.

Arkansas Individual Income Tax Return AR1000F Step 6: Two columns are provided throughout the rest of the form. Those filing taxes separately on the same return with their spouse should enter their spouse's information in column B. Those filing jointly or simply should enter their information in column A. Document your income as instructed on lines 8 through 20. Total these values and enter the sum on line 21.

Arkansas Individual Income Tax Return AR1000F Step 7: Follow the instructions on lines 22 through 24 to calculate your adjusted gross income.

Arkansas Individual Income Tax Return AR1000F Step 8: Calculate your total tax as instructed on lines 25 through 31.

Arkansas Individual Income Tax Return AR1000F Step 9: Calculate your net tax as instructed on lines 32 through 36.

Arkansas Individual Income Tax Return AR1000F Step 10: Lines 37 through 44 document payments already made.

Arkansas Individual Income Tax Return AR1000F Step 11: Lines 45 through 51 provide the final calculations necessary to determine your tax owed or refund due.

Arkansas Individual Income Tax Return AR1000F Step 12: Sign and date the form. Enter your occupation and home telephone as well. If filing jointly, your spouse should sign and date the form, provide their occupation, and enter their work phone number.

Arkansas Individual Income Tax Return AR1000F Step 13: Any paid preparer should sign the form and provide all identifying information requested.