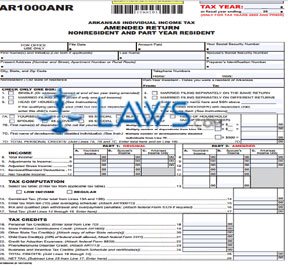

Form AR1000ANR Nonresident Individual Income Tax Amended Return

INSTRUCTIONS: ARKANSAS INDIVIDUAL INCOME TAX AMENDED RETURN NONRESIDENT AND PART YEAR RESIDENT (Form AR1000ANR)

Nonresidents and part year residents of Arkansas who need to amend their initially filed tax return do so by filing a form AR1000ANR. This article discusses the version of this form which is only to be completed for tax years 2009 and earlier. The document, as well as forms for more recent years, can be found on the website of the Arkansas Department of Finance and Administration.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 1: At the top right, give the calendar or fiscal year dates for which you are filing.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 2: Give your name, address, telephone number and Social Security number. The same information must be provided for your spouse if filing jointly.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 3: If you are a non-resident, give your state of residence.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 4: If you were a part-year resident, give the dates during which you resided in Arkansas.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 5: Check the box next to the statement indicating your filing status on lines 1 through 6.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 6: Lines 7A through 7D concern dependents.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 7: Lines 8 through 12 concern your income. The first three columns require you to give your income, your spouse's income and your Arkansas income only as reported on your original return. The second three columns require the same information as amended.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 8: Lines 13 through 17 provide instructions for computing your tax due.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 9: Lines 18 through 27D concern tax credits.

Arkansas Individual Income Tax Amended Return Nonresident And Part Year Resident AR1000ANR Step 10: Lines 28 through 35 concern payments. Lines 36 and 37 concern refunds or tax payments due. Sign and date the form and give your occupation. If filing jointly, your spouse must do the same.