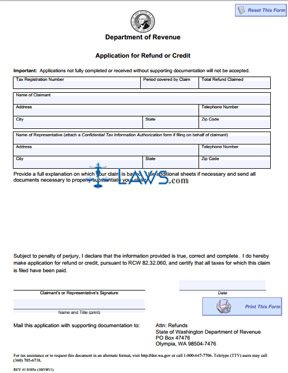

Form Application for Refund or Credit

INSTRUCTIONS: WASHINGTON APPLICATION FOR REFUND OR CREDIT (Form 41 0105e)

A form 41 0105e is completed by Washington sellers claiming a refund or credit to their sales tax account on the basis of overpaid taxes, interest or penalties. This document is also used by buyers who paid retail sales tax on a purchase which did not require it and are unable to obtain a refund from a seller who is out of business, who has moved or cannot be located, who is financially unable to provide the refund, or who refuses to directly refund the retail sales tax but agrees that it should not have been assessed. This form is available on the website of the Washington State Department of Revenue.

Washington Application For Refund Or Credit 41 0105e Step 1: On the first line, enter your tax registration number, the period the claim concerns, and the size of the total refund being sought.

Washington Application For Refund Or Credit 41 0105e Step 2: On the second line enter your name.

Washington Application For Refund Or Credit 41 0105e Step 3: On the third line enter your street address and telephone number.

Washington Application For Refund Or Credit 41 0105e Step 4: On the fourth line enter your city, state and zip code.

Washington Application For Refund Or Credit 41 0105e Step 5: You can appoint a representative who is authorized to speak with the Department of Revenue on your behalf. If you wish to do so, enter their name, address and telephone number in the box below. You must also attach a Confidential Tax Authorization form.

Washington Application For Refund Or Credit 41 0105e Step 6: In the blank space below, provide a written explanation of the basis for your claim for a refund or credit. Attach additional sheets if necessary.

Washington Application For Refund Or Credit 41 0105e Step 7: Attach all documentation which substantiates your claim. This can include invoices, resale certificates, sales tax exemption certificates, proof of payment of sales tax, a detailed list of bad debts, contracts, sales documents, and proof a customer has received credit or a refund.

Washington Application For Refund Or Credit 41 0105e Step 8: The claimant or their representative should sign and date the form, as well as printing their name and title.