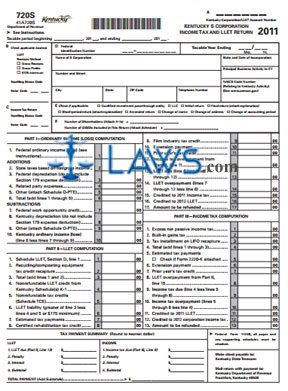

Form 720S Kentucky S Corporation Income Tax

INSTRUCTIONS: KENTUCKY S CORPORATION INCOME TAX AND LLET RETURN (Form 720S)

Kentucky S corporations file their state income tax, as well as their Limited Liability Entity Tax (LLET), with a form 720S. This document can be obtained from the website of the Kentucky Department of Revenue.

Kentucky S Corporation Income Tax And LLET Return 720S Step 1: At the top of the form, enter the beginning and ending dates of your fiscal year if not filing on a calendar year basis.

Kentucky S Corporation Income Tax And LLET Return 720S Step 2: Indicate your LLET receipts method with a check mark in section B. If you are not filing income tax, enter your nonfiling status code in section C.

Kentucky S Corporation Income Tax And LLET Return 720S Step 3: In section D, enter your federal identification number, the end date of your taxable year, your S corporation's name, address and telephone number, the state and date of its incorporation, its principal business activity within the state, and its NAICS code.

Kentucky S Corporation Income Tax And LLET Return 720S Step 4: In section E, check any applicable statements regarding the status of this return.

Kentucky S Corporation Income Tax And LLET Return 720S Step 5: In section F, write the number of shareholders and the number of Q SSS's included in the return.

Kentucky S Corporation Income Tax And LLET Return 720S Step 6: In Part I, compute your income or loss as instructed.

Kentucky S Corporation Income Tax And LLET Return 720S Step 7: To complete Part II, you must first complete the separate schedule LLET. Follow the instructions to compute your LLET due.

Kentucky S Corporation Income Tax And LLET Return 720S Step 8: In Part III, follow the directions to compute the income tax due.

Kentucky S Corporation Income Tax And LLET Return 720S Step 9: Complete the Tax Payment Summary section at the bottom of the form as directed.

Kentucky S Corporation Income Tax And LLET Return 720S Step 10: Attach a copy of your federal 1120S return, as well as all supporting documentation.

Kentucky S Corporation Income Tax And LLET Return 720S Step 11: Complete the Schedule Q questionnaire on the second page and provide all information requested about your company's principal officer. The company's principal officer or chief accounting officer should sign and date the form.