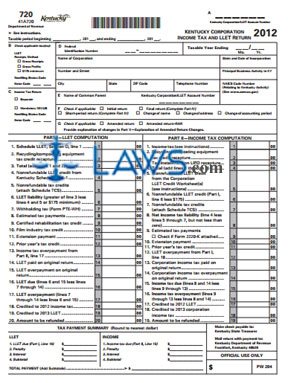

Form 720 Kentucky Corporation Income Tax

INSTRUCTIONS: KENTUCKY CORPORATION INCOME TAX AND LLET RETURN (Form 720)

Kentucky corporations file their income taxes, as well as their Limited Liability Entity Tax (LLET), with a form 720. This document is obtained from the website of the Kentucky Department of Revenue.

Kentucky Corporation Income Tax And LLET Return 720 Step 1: If not filing on a calendar year basis, enter your fiscal year's beginning and ending dates at the top of the form.

Kentucky Corporation Income Tax And LLET Return 720 Step 2: Indicate your LLET receipts method with a check mark in box B.

Kentucky Corporation Income Tax And LLET Return 720 Step 3: Indicate the type of income tax return being filed in box C with a check mark. If you are not filing this tax, enter your nonfiling status code.

Kentucky Corporation Income Tax And LLET Return 720 Step 4: Enter your federal employer identification number in box D, along with the ending month and year of the taxable year you are filing for, your corporation's name and address, the state and date of its incorporation, its principal business activity in the state, and its NAICS activity code. If you have a parent company, enter its name and state account number in box E.

Kentucky Corporation Income Tax And LLET Return 720 Step 5: In box F, indicate with a check mark if filing an initial or final return, one documenting a change of name, address or accounting period, or if filing a short-period return. In box G, indicate with a check mark if you are filing an amended return or an amended return RAR.

Kentucky Corporation Income Tax And LLET Return 720 Step 6: Complete the separate schedule LLET, then complete Part I to compute the tax owed.

Kentucky Corporation Income Tax And LLET Return 720 Step 7: Compute your income tax owed as instructed in Part II.

Kentucky Corporation Income Tax And LLET Return 720 Step 8: Transfer the information from Parts I and II as directed to complete the tax payment summary at the bottom of the first page.

Kentucky Corporation Income Tax And LLET Return 720 Step 9: Compute your taxable income as instructed in Part III.

Kentucky Corporation Income Tax And LLET Return 720 Step 10: Part IV requires an explanation of those filing a final or short-period return. Part V requires an explanation from those filing an amended return.