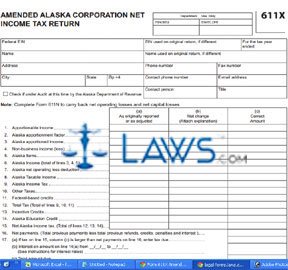

Form 611X Amended Alaska Corporate Net Income Tax Return

INSTRUCTIONS: AMENDED ALASKA CORPORATION NET INCOME TAX RETURN (Form 611X)

Alaska corporations should use a form 611X if they need to amend an initially filed net income tax return. This document is found on the website of the Alaska Department of Revenue.

Amended Alaska Corporation Net Income Tax Return 611X Step 1: Enter your Federal Employer Identification Number (FEIN), your business name and complete address, your phone and fax number, and a contact person's name, title, phone number and email address.

Amended Alaska Corporation Net Income Tax Return 611X Step 2: If you had a different name or FEIN on your original return, enter it. Give the tax year for which you are filing.

Amended Alaska Corporation Net Income Tax Return 611X Step 3: If you are being audited by the Alaska Department of Revenue, indicate this with a check mark where indicated.

Amended Alaska Corporation Net Income Tax Return 611X Step 4: Lines 1 through 15 provide instructions for the calculation of your net Alaska income tax due. On these lines, three columns must be completed. Column a requires you to enter the numbers filed on your initial or last amended return. Column b requires you to detail the net change between the original and amended figures. Column c requires you to enter the correct amounts.

Amended Alaska Corporation Net Income Tax Return 611X Step 5: Lines 1 through 6 provide instructions for detailing your Alaska income.

Amended Alaska Corporation Net Income Tax Return 611X Step 6: Lines 7 through 12 provide instructions for calculating the Alaska tax owed.

Amended Alaska Corporation Net Income Tax Return 611X Step 7: Lines 12 through 15 provide instructions for calculating your adjusted Alaska tax owed after credits have been applied.

Amended Alaska Corporation Net Income Tax Return 611X Step 8: Lines 16 through 18 adjust your tax due based on payments already made.

Amended Alaska Corporation Net Income Tax Return 611X Step 9: You must attach an explanation of all changes reported. If you have filed an amended federal return, a copy must be attached.

Amended Alaska Corporation Net Income Tax Return 611X Step 10: An officer of the company should sign and date the form and provide their title.

Amended Alaska Corporation Net Income Tax Return 611X Step 11: The file containing this form includes a form 611N if you wish to apply for a tentative refund based on overpayment.