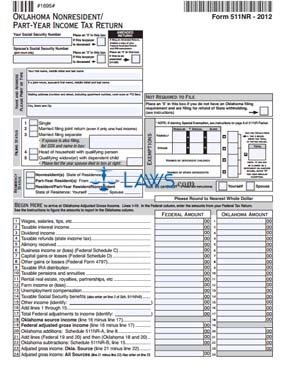

Form 511NR Oklahoma Nonresident Part-Year Income Tax Return

INSTRUCTIONS: OKLAHOMA NONRESIDENT/PART-YEAR INCOME TAX RETURN (Form 511NR)

Those who derived income from Oklahoma as non-residents or part-year residents file their state income tax owed using a form 511NR. This can be obtained from the website of the Oklahoma Tax Commission. The same form is used to file an amended return.

Oklahoma Nonresident/Part-Year Income Tax Return 511NR Step 1: At the top of the first page, enter your Social Security number, as well as that of your spouse if filing jointly. Indicate with a check mark whether either party is deceased or if you are filing an amended return.

Oklahoma Nonresident/Part-Year Income Tax Return 511NR Step 2: Enter your full name and address. If filing jointly, include your spouse's full name as well.

Oklahoma Nonresident/Part-Year Income Tax Return 511NR Step 3: Indicate your filing status with a check mark.

Oklahoma Nonresident/Part-Year Income Tax Return 511NR Step 4: If you are filing as a non-resident, enter your state of residence. If you are filing as a part-year resident, give the starting and ending dates of your residence. Indicate with a check mark if you or your spouse is over the age of 65.

Oklahoma Nonresident/Part-Year Income Tax Return 511NR Step 5: Lines 1 through 24 provide instructions for calculating your adjusted gross income. Enter all numbers concerning your total income in the column on the left headed "Federal Amount" and the amounts relating to income only derived from Oklahoma in the column on the right. Complete lines 1 through 19 as instructed.

Oklahoma Nonresident/Part-Year Income Tax Return 511NR Step 6: To determine your Oklahoma additions on line 20, complete schedule 511NR-A on the third page. Complete line 21 as instructed. Complete schedule 511NR-B on the third page to determine your subtractions on line 22. Complete lines 23 and 24 as instructed.

Oklahoma Nonresident/Part-Year Income Tax Return 511NR Step 7: Complete line 25 as instructed. Complete schedule 511NR-C to determine your adjustments on line 26. Complete lines 27 through 32 as instructed.

Oklahoma Nonresident/Part-Year Income Tax Return 511NR Step 8: If claiming a child care or child tax credit, complete schedule 511NR-D on the fourth page and enter the result on line 33. Complete lines 34 through 52 as instructed. To determine your earned income credit on line 46, you will need to complete schedule 511NR-E.