Form 500 Individual Income Tax Return

INSTRUCTIONS: GEORGIA INDIVIDUAL INCOME TAX RETURN (Form 500)

Those who owe income tax to Georgia as full-year or part-year residents or as non-residents can file using a form 500. You should first consult the qualifications for the short-form 500EZ document to see if you are eligible to use that form instead. Both documents are found on the website of the Georgia Department of Revenue.

Georgia Individual Income Tax Return 500 Step 1: At the top of the form, enter the beginning and ending dates of your fiscal year if you do not file on a calendar year basis.

Georgia Individual Income Tax Return 500 Step 2: Give your name and Social Security number, as well as that of your spouse if filing a joint return.

Georgia Individual Income Tax Return 500 Step 3: Give your full address and check the box if this has changed since your last return.

Georgia Individual Income Tax Return 500 Step 4: In box 4, enter "1" if a full-year resident, "2" if a part-year resident, and "3" if a non-resident. Part-year residents should enter the dates of their residency in the state. Part-year residents and non-residents cannot complete lines 9 through 14 below and must complete schedule C on the sixth page and transfer the results from there to line 15.

Georgia Individual Income Tax Return 500 Step 5: Indicate your filing status on line 5.

Georgia Individual Income Tax Return 500 Step 6: Enter the number of exemptions claimed on line 6.

Georgia Individual Income Tax Return 500 Step 7: In section 7, give the name, Social Security number and relationship to you of all dependents. Total your dependents on line 7a, add these to the exemptions on line 6, and enter the total on line 7b.

Georgia Individual Income Tax Return 500 Step 8: Follow instructions on lines 8 through 10 to determine your state adjusted gross income.

Georgia Individual Income Tax Return 500 Step 9: Standard deductions are claimed on line 11, while itemized deductions are claimed on line 12. Whichever you claim, subtract it from line 10 and enter the difference on line 13.

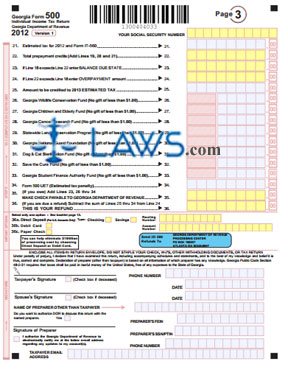

Georgia Individual Income Tax Return 500 Step 10: Follow instructions on lines 14 through 36 to calculate your balance owed or refund due.

Georgia Individual Income Tax Return 500 Step 11: Sign and date the bottom of the third page and provide your phone number.